An Explanation: What is Bitcoin

Money in electronic form is not new; it has existed for decades– so far it has been controlled by central banks. In the 1950s and 1960s, credit cards arose and soon after Automated Teller Machines (ATMs) became a regular fixture on high streets around the globe. These innovations intensified the trend towards electronic money, where money balances are held exclusively electronically by banks. In the US, about 5-8% of money in banks exists in physical form; the remaining 92-95 % of money is almost entirely created digitally. For example, when a bank such as JPMorgan Chase issues a mortgage (for which banks take the deeds of the house as security), it uses newly created money that is then paid out to the customer—the money didn’t exist before. Research by Positive Money has shown that money creation has been growing by 11.5% per annum, since 1989 (Frisby, 2014). The pace of electronic money creation accelerated in 2020 as central banks flooded the market with new money to stimulate the economy during the COVID-19 “pandemic.”

Data from the Federal Reserve shows that the broad measure of the stock of dollars, known as M2, rose from $15.4 trillion at the start of 2020 to $21.18 trillion in December 2021. M2 is a measure of the money supply that includes cash, checking & saving deposits and easily convertible near money, like treasury bills and money market funds. The $5.78 trillion increase represents 27.28% of the total dollar supply. That means more than one in four dollars was created in 2020 and 2021 (FRED).

M2 is a measure of the money supply that includes cash, checking & saving deposits and easily convertible near money, like treasury bills and money market funds.

The US dollar is the global reserve currency. The United States, five US territories and seven sovereign countries use it as their official currency, while more than 65 countries peg their currencies to the US dollar. The US central bank, the Federal Reserve, is responsible for controlling the US dollar money supply. The Fed creates money through open market operations, by buying securities in the market with newly created money, or by creating bank reserves that are issued to commercial banks. Bank reserves are multiplied through fractional reserve banking, where banks can lend a multiple of the deposits they have on hand. This is designed to continuously stimulate the amount of money available in the economy while keeping just enough money in bank vaults to fulfil withdrawal requests (Pritchard,J; 2021).

Central banks have not always arbitrarily controlled the money supply. Until World War I, the gold standard gave an underlying value to currencies issued by central banks. Each country defined its national currency in terms of a fixed weight of gold. The gold standard was one of the longest-standing financial institutions in history. It was successful because, like the economic law of gravity, the standard was based on an equation between value and mass, it was global, and it was easy to understand so everyone knew where they stood.

The gold standard finally ended in 1971 with the “Nixon shock” when President Nixon broke the peg between the US dollar and gold on August 15, 1971. This created the fiat monetary system. “Fiat money” (from Latin: fiat = “let it be done”) is a type of money that is not backed by a commodity such as gold and derives its value entirely from government decrees. Fiat is a command or act of will that creates something without or as if without further effort. According to the Bible, the world was created by fiat, as God said ‘let there be light’ (Latin: “fiat lux“).

Governments create fiat money ‘ex nihilio’,- from nothing. Its value does not come from the material it is made of or from the resource from which it derives its underlying value, but from the value it represents according to the economy in which it is used in. It is a debt based system, in which central banks create and lend out fiat money solely in return for the promise of the recipient to repay. The term fiat suggests the autocratic attitude of a process. For example, many coups involve the imposition of a new government by military fiat, a process where a decision is made and enforced by radical military means. Fiat Money places full control over inflation, monetary flows and its value with the government. People use fiat money, because they have trust in the government and institutions that issue fiat money, also known as fiduciary money (from Latin: fidere = ‘to trust’ ).

The problem with the fiat monetary system is that an increase in the money supply is not automatically distributed evenly across all areas of the economy. This phenomenon is known as the “Cantillon Effect”, named after 18th-century economist Richard Cantillon, indicates that money is not neutral because inevitably it is injected unevenly, creating economic distortions. These distortions are impactful. ‘Money matters a great deal in concrete terms in the immediate short run and has permanent long-run effects. Given that the global economy has experienced more than a decade of radical and unproven monetary policy by central banks and half a century of fiat currencies’ (Arkadiusz Sieroń). The effects of money are increasingly relevant, because they continuously widen the wealth gap in society. Money created by central banks is distributed to other banks and finds its way to the sectors that are closest, such as banking, financial markets or real estate,- and does not benefit the general public.

Traditional centralized banking systems like the Federal Reserve System are subject to boards and government institutions controlling the supply and distribution of money. Bitcoins in contrast are entirely produced by the system collectively, by a rate which was defined when the system was created and known to the public. As of today, no one has been able to either disturb the mining process or crack how to mine without using the required Bitcoin software with its internal security and self-relying value system (Antonopoulos, 2015).

Today, money is at the mercy of central banks. In the past, money used to be tied to a resource, like gold. Gold is a physical resource, which has to be mined. Bitcoins also have to be “mined”. One can do so by downloading the Bitcoin software, running it on a computer and connecting to the Bitcoin network. In the early stages, ordinary computers could “mine”, but as bitcoins have grown in value so has competition to mine them – as a result more powerful and specialised computers are needed.

Bitcoin mining describes the process of creating new bitcoin by authorising payments. The system is known as “proof-of-work” as miners work on bitcoin transactions by coming up with the best combination to store that information. Bitcoins distributed ledger, the block chain, is the network’s transaction history. The block chain is a “gossip protocol”, meaning that all modifications are broadcasted to all network participants. It is important that users agree on the same information, because the Bitcoin network is decentralised, functioning without a central authority.

By mining, one maintains the Bitcoin block chain and adds and verifies the records of every recent transaction on the public network, merging it all into a block, which is added to the existing block chain (Frisby, 2015). A block is like a page in an accounting book. Once a block is added, it can never change. One ought to imagine a database of every dollar transaction ever made. That is what the block chain is for Bitcoin, a comprehensive public database.

The mining process can be understood as a lottery to solve an algorithmic problem. Miners are guessing a random number (a nonce), whoever does so the fastest confirms the next block and is rewarded. Every block triggers a ‘block reward’ issued to whomever successfully mined the block. The newly generated coins are called a Coinbase. A block reward also includes transaction fees. The transaction fees are paid by the users in order to incentivise miners to confirm their transaction. The newly generated coins represent the biggest part of the block reward. On average, a block of verified transactions is added to the existing block chain every 10 minutes.

Bitcoin mining is a digital replication of the physical mining process. The deeper the mine gets, the more expensive and more labor intensive it gets – caused by the high power consumption. The cost of bitcoin production is the maintenance of the block chain. “The system is self-reinforcing” (Frisby, p: 25, 2014). People’s incentive is to maintain the blockchain out of self-interest. Miners provide computing power to the network, for which they are rewarded with newly minted bitcoins and bitcoin transaction fees. Those who engage in mining become the public record keeper and regulators, acting as a decentralized bank.

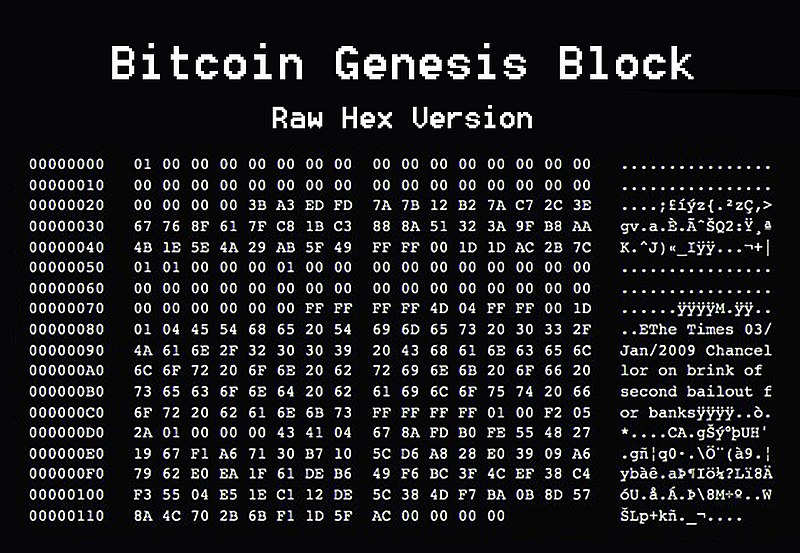

The first block in the Bitcoin block chain, the Genesis Block, was mined on January 3rd 2009. The Bitcoin Genesis Block includes a reference to The Times headline “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” as a proof that the block was created on January 3, 2009, as well as a comment on the instability caused by the fiat monetary system.

What is Bitcoin?

The Oxford dictionary defines software as ‘programs and other operating information used by a computer’. Bitcoin is software. The Bitcoin software provides a secure way of transaction. Next time you are typing in a web address, pay attention to how in front of a website url the letters ‘http’ appear, which stands for Hypertext Transfer Protocol. A protocol is a set of rules for computer systems to communicate with each other and exchange information. It can be implemented by hardware, software, people, or a combination of all of them. Usually, the specified behavior of a protocol is independent of any particular implementation (Leffler J. 2016). For example, when you enter a web address, you send an http command to transfer a website, and the website is displayed as a webpage on your device, retrieved from a web server.

Website URL: asystemofrules.com

The Bitcoin software implements a protocol functioning as a specified set of rules for computer systems

to send and receive payment information. With Bitcoin – notice the capital B – a computer reaches out to another computer. By doing so the computer provides binary-coded information proving to control a certain number of bitcoins – notice the lower case b – and the information that one wishes to increase or decrease ones controlled number of bitcoins by engaging in a transaction with the other address, which also provides binary-coded information proving to control a certain number of bitcoins (Frisby, 2014).

‘bitcoin’ – written with a lower case b, is the monetary unit used in the Bitcoin network. For comparison: the Euro € is the monetary unit used in the European banking network. Making Bitcoin a network and a monetary unit (Frisby, 2014), an integral and decentralized, self-regulating, peer-to-peer payment network that is spread out across thousands of computers around the globe that agree to the same set of protocol rules and means of payment. It is a transaction processing system that runs without a physical location. Actually, we can define Bitcoin as three things:

Bitcoin the Protocol: A specified set of rules for computer systems to communicate with each other and exchange information, implemented by software.

Bitcoin the Network: A decentralised network of computers that communicate with each other and exchange information using the Bitcoin protocol.

bitcoin the Asset: The monetary unit used in the Bitcoin network.

From the network’s transaction processing capability comes the ability to exchange money, which is bitcoin, the representation of the value of the underlying system. ‘bitcoin’ is at least four-ways ambiguous in present usage. It can be used as a mass noun for a kind of stuff (‘he has bitcoin’), a unit of measurement for that stuff (‘his has 2.3 bitcoin’), a count noun (‘he has two bitcoins’), and a name for the entire network, which is then capitalised. The smallest unit of bitcoin (in the mass noun sense) is a satoshi, in honour of bitcoin’s pseudonymous inventor. 100 million satoshi equal a single bitcoin (in the count noun sense). I will usually use ‘bitcoin’ in the mass noun sense, and ‘the Bitcoin network’ to refer to the network overall. Otherwise, the context should indicate whether I’ve used ‘bitcoin’ as a count noun or as a unit of measurement (Warmke, C., 2020).

Bitcoin is na new kind of financial system.For the first time in history, a payment network exists outside of government control. Gold historically held a degree of immunity against government control. But government decrees in the past have made the private ownership of gold illegal. Under US President Franklin D. Roosevelt in 1933, on April 5th, Executive Order 6102 required all US citizens to surrender all privately held gold, including coins, bars, and gold certificates valued over 100$, to the Federal Reserve in exchange for $20.67 per troy ounce.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” F.A. Hayek 1984

The internet has democratized many aspects of our lives, from travel to media distribution and commerce. By architecture, the internet is a set of open-source protocols for permissionlessly moving information worldwide. When most people talk about ‘the Internet’, they are actually referring to the World Wide Web, with its underlying Hypertext Transfer Protocol. The internet is made up of different protocols. The foundational protocols of the Internet are the Transmission Control Protocol (TCP) and the Internet Protocol (IP), together referred to as TCP/IP. The first provides a delivery system to stream digital information between applications running on the internet and the later is the network layer for relaying data across network boundaries, its function of selecting a routing path between networks enables the connection between different computers and essentially establishes the Internet as such.

As Robert Breedlove has pointed out, ‘constructed in a free market manner, through years of cooperation and standardization efforts, the internet is the greatest knowledge network in history. Today, we all benefit from this readily-accessible library of human knowledge’. Bitcoin complements the internet as an open-source protocol for permissionlessly moving value worldwide in an instant, lowering the barriers of entry to finance. Anyone with an internet connection and a smartphone can now participate in the global economy, trade and independently store wealth. Bitcoin uses peer-to-peer technology to operate with no central authority: managing transactions and issuing money are carried out collectively by the network.

Bitcoin’s software code is open source, meaning it is being developed and maintained in a collaborative public manner, no single entity controls Bitcoin. There are miners, people that create bitcoin. Users, people that use Bitcoin and developers, people that help to write code. Bitcoin Core is the name of the open source software which enables the use of Bitcoin. Open source is a way for people to collaborate on software without being encumbered by all of problems of intellectual property. The Bitcoin software is licensed under an MIT License, which is a permissive free software license originating at the Massachusetts Institute of Technology in the late 1980s. A short and simple license with conditions only requiring preservation of copyright and license notices. Licensed works, modifications, and larger works may be distributed under different terms and without source code.

The idea of an internet native currency is not new. The 402 Payment Required is an error status response code in the HyperText Transfer Protocol that is reserved for future use. It was created to enable micropayments and would indicate that the requested content is not available until paid for. The idea was to allow content creators to be directly paid on the internet. However, there was no digital cash to be used and advertisement turned into the ‘currency of the internet’.

Bitcoin has similarities to a well known internet application protocol, the Simple Mail Transfer Protocol (SMTP), the internets standard communication protocol for electronic mail transmission (E-mail), which allows two computers to send messages to each other in the form of E-mail. Bitcoin is similar to E-mail, as it also allows for person to person exchange of information. The difference, and what sets Bitcoin apart from all other internet protocols, is its ability to allow for the direct exchange of unique and independently verifiable information.

When information is sent online, an E-mail for example, a user sends a copy of the information, which is arbitrarily duplicatable. This is known as “the double spending problem”, which describes the risk that digital objects can be imitated and spent twice. Which, before bitcoin, made data unfit to function as money. Money has value by definition, and something that can be duplicated at will is not valuable. Satoschi Nakamoto solved the double spending problem with a combination of two things: the introduction of an immutable linear trail of transaction history for all bitcoins spent (the block chain), to ensure they have not been double‑spent and the bitcoin mining “proof-of-work” consensus algorithm, which allows all network participants to agree on the same transaction history.

The problem of consensus building in a computer network is known as the “Byzantine Generals Problem,” which addresses the following dilemma: Imagine a number of Byzantine generals outside a city they are about to attack. They can only win the battle if all generals attack at the same time. Since some players are always reliable, how can the generals agree on a common strategy without coordination and avoid failure ? This problem applied to a computer network extends to much larger orders of magnitude since computer networks have many participants.

Satoschi Nakamoto solved the Byzantines Generals Problem by introducing the Bitcoin block chain based on proof-of-work. Miners have to expend energy to work on bitcoin transactions by finding the best combination to store that information. The benefit of cheating is less than the economic reward for honest behavior and receiving the block reward for successfully confirming a block. Cheating in Bitcoin is unprofitable. Users that have cost contributing to a network are incentivised to not act dishonest and damage the network, as doing so would incur costs without reward. These protocol rules made it possible to set up a network in which a majority of network participants agreed on a common strategy. Before Bitcoin, third parties needed to verify the transactions processed in the transfer of money. In Bitcoin, the verification process is taken on by everyone in the network.

“What Satoshi figured out — is how to independently agree upon a history of events without central coordination “(Gigi).

Bitcoin is the first successful attempt to create a digital property which can be send securely to someone else without a third-party intervention. It is sound money, backed by computer science. Sound money is money that is not subject to depreciation of purchasing power over the long term, supported by self-correcting mechanisms inherent in a free market system. Fiat money is not sound. Central banks continuously debase fiat currencies by increasing the money supply. The result is inflation, which is the loss of purchasing power of money. Gold, for example, is sound money and has historically served as a monetary unit to store wealth and protect money from inflation. The scarcity of precious metals is governed by natural laws that are beyond the control of man, making their supplies fairly resistant to manipulations. Gold persisted for thousands of years as the preferred monetary metal across a number of independent societies, because of two key components. Gold is both, indestructible and cannot be artificially created, which has ensured its relatively inelastic supply.

Gold still holds the characteristics of sound money, however, even though gold works well across time, it does not work well across space (it is too heavy to carry) and has no application on the internet. Bitcoin inherited some neat features from gold, like scarcity, but it introduced a new dimension (@candlehater). Namely, that it is easier to store and move around. A better, more liquid store of value, that can be sent anywhere in the world at the speed of light. It is a purpose build money for the digital age – permissionless, open-source and global.

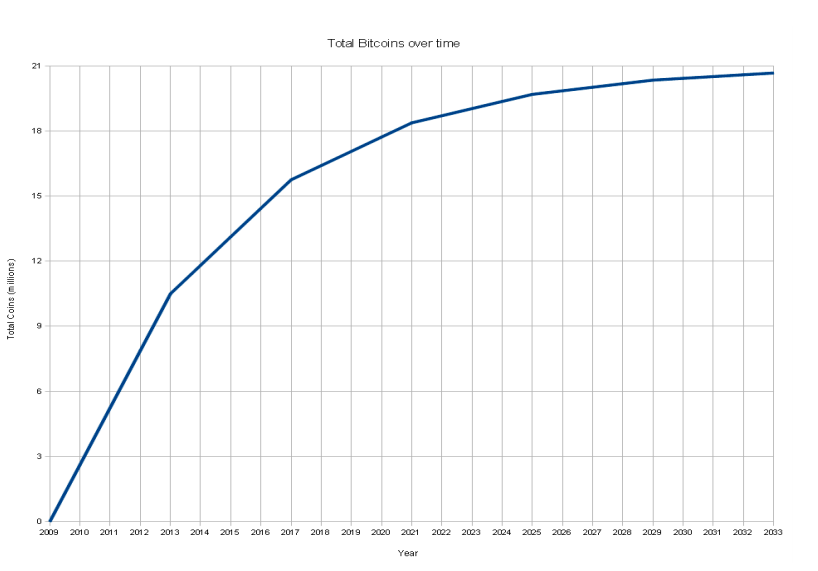

Bitcoin enforces its ‘soundness’ through a pre-defined schedule hardwired into the protocol. It limits the total number of Bitcoins so that they gradually approach a total of 21 million. The block reward that the system issues to a miner who successfully confirmed a block is reduced in stages. When Bitcoin was launched in 2009 each block introduced 50 new coins into the system. This quantity halves every 210,000 blocks. So, the limit of coins is subject to (50 x 210000) X (1 / 1 – 0,5) = 21.000.000. This figure includes those that have been lost and there will never be more bitcoins than this.

The Table shows the number of bitcoins over time (via bitcoin.stackexchange.com)

Jameson Lopp explains how the 21 million limit in Bitcoin is enforced. As he explains, the 21 million limit was not stated by Satoschi Nakamoto in the white paper. The main function that enforces this limit is the halving of the block reward. The system checks that the block reward is what it’s expected to be for any given block, not the total supply. Of course, the total supply can be checked, but that’s done at user request, not by default.

Bitcoin derives its core value from its fixed supply. The system is disinflationary and designed to be deflationary. This means that the value of bitcoin is meant to increase over time. According to game theory, which is the study of mathematical models of strategic interactions among rational actors, in order for the Bitcoin network to grow, it must be desirable to join. The surge in bitcoin’s price naturally arouses the interest of market participants, who join the network. In turn, the network will become more resilient and decentralised, and bitcoin will become more valuable due to increased demand. A positive feedback loop of price and network growth.

A Bitcoin block reward halving occurs on average every four years. Usually, bitcoins price increases with every halving. Basic economic theory tells us that when the supply of a good is less than the demand, price should rise. Even if demand doesn’t increase, supply will decrease, causing the price to rise. However, the event’s impact isn’t felt immediately, but instead occurs with time. The first halving took place on November 28, 2012, after a total of 10,500,000 bitcoin was mined. The block reward halved to 25 bitcoin. The second block halving happened in 2016, when the block reward halved to 12,5 bitcoin. The last halving, the third overall, took place on May 12 2020, and brought the current block reward to 6.25 bitcoin. Each halving eventually let to a surge in bitcoin price, with three bitcoin bull markets (2013, 2017 and 2021) following within a year of each halving. The next halving is scheduled for 2024, reducing the block reward to 3.125 bitcoin. By then, around 95% of all bitcoins will be mined. The last bitcoin will be mined around 2140. After that, the system will run on transaction fees paid by users.

The halving does not affect the 10-minute time between each block, only the reward. The 10-minute time frame is directly related to the difficulty adjustment, which is automatically adjusted by the network every 2016 blocks based on the time it took to find the previous 2016 blocks. At the desired rate of one block every 10 minutes, finding 2016 blocks would take exactly two weeks. If the previous 2016 blocks took longer than two weeks to find, the difficulty will be decreased, if it took less, the difficulty will be increased. The difficulty is a measure of how difficult it is to mine a block. A high difficulty means that it will take more computing power to mine the same number of blocks.

The difficulty is adjusted based on the amount of computational power on the network. Mining power is estimated in Hash Rate (TH/s). The hash rate represents the speed at which a computer is completing an operation in the Bitcoin code (e.g. its computational power). As more and more people compete to confirm transactions, the hash rate increases. Alternatively, when fewer people compete with each other, the hash rate goes down. The higher the hashrate, the higher the difficulty, and vice versa. In order to keep the time it takes to mine a block roughly stable at 10 minutes. The function of the difficulty-adjustment has been sagely explained by Gigi, who points out that “the difficulty-adjustment is about keeping a constant time, not a constant level of security, difficulty, or energy expenditure. This is ingenious because good money has to be costly in time, not energy. Linking money to energy alone is not sufficient to produce absolute scarcity since every improvement in energy generation would allow us to create more money. Time is the only thing we will never be able to make more of. It is The Ultimate Resource, as Julian Simon points out. This makes Bitcoin the ultimate form of money because its issuance is directly linked to the ultimate resource of our universe: time.” (Gigi ‘bitcoin is time’, 2021)

At the moment about 900 bitcoins are created every day. The annual increase to the total Bitcoin money supply is currently 1.8%. To compare over the past 50 years, the US dollar has only managed to fall below two percent in 1993 and 1994 (Stroukal, D. (2020). “The Economics of Halving: What Will Happen to the Price?”). Eventually, bitcoin’s inflation rate will drop to zero. An asset with a perfectly scarce supply schedule, something that has never existed before.

Continue reading: An Explanation: Using Bitcoin

If you enjoyed this piece, you can send me a tip to:

⚡ law@getalby.com

Follow me

leonwankum.com

Twitter (X)

Nostr