Bitcoin means Scarcity

“The invention of Bitcoin represents the discovery of absolute scarcity, or absolute irreproducibility, which occurred due to a particular sequence of idiosyncratic events that cannot be reproduced. Any attempt to introduce an absolutely scarce or diminishing supplied money into the world would likely collapse into Bitcoin (as we saw with the Bitcoin Cash fork). Absolute scarcity is a one-time discovery, just like heliocentrism or any other major scientific paradigm shift. In a world where Bitcoin already exists, a successful launch via a proof-of-work system is no longer possible due to path-dependence; yet another reason why Bitcoin cannot be replicated or disrupted by another cryptoasset using this consensus mechanism. At this point, it seems absolute scarcity for money is truly a one-time discovery that cannot “disrupted” any more than the concept of zero can be disrupted.” (Robert Breedlove)

Bitcoins limited supply cap introduces a new paradigm to money: absolute scarcity. In a world were money is abundant, a type of money that is limited will outcompete any type of money that is not. Historically, gold has been the scarcest money, with an annual supply increase of 1,2-1,5%. Bitcoin’s inflation rate is gradually approaching zero. Bitcoin addresses a fundamental problem: Central banking, which deprives the individual of monetary sovereignty. You can’t possibly own something, that is controlled by someone else and constantly diluted.

The continuous issuance of money by central banks has evaporated the purchasing power of fiat currencies. This has turned all fiat based instruments, including stocks, bonds and real estate into very risky assets and cash from an asset to a liability. The god news is, governments have no power over Bitcoin, the supply won’t change.

The value of money has deeper implications for society. As Robert Breedlove has pointed out, ‘money is a messaging system that conveys both past and expected future actions. Money is the language of value which mediates this relationship between present actions and envisioned futures by expressing prices and enabling economic calculation. The distortion of such system, will lead to a distorted society and economic depression.’

A similar observation has been made by Jimmy Song who explains that ‘money’s emptying out of value, that is through debasement and loss of soundness, causes an artificiality throughout society. In other words, phony money results in phony people and phony people are more or less willing to suspend reality for the sake of getting along. The artificiality of money spreads to people and institutions like cancer, causing so much of the craziness we see today.’

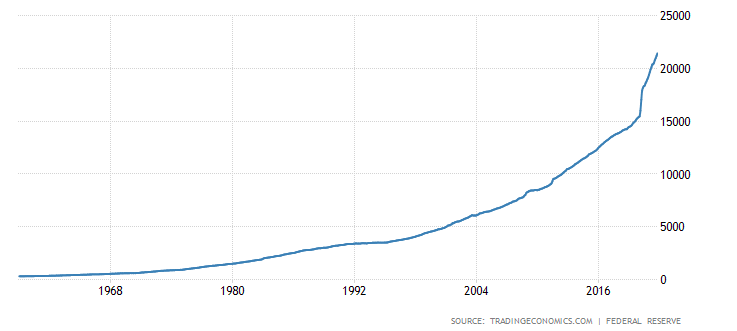

As a response to the great economic depression of the early 1930’s in the US that affected global markets, British Economist John Maynard Keynes published a book in 1936 entitled “The General Theory of Employment, Interest and Money”, in which he advocated for an active role of governments in the economy in times of crisis, for example through the supply of money. The US government and its European allies adopted Keynes ideas. Over time, government misused their control of the money supply, in order to print money, when faced with liquidity issues. Like a school child eating too much candy, government’s tasted the sweetness of uncontrolled fiscal manipulation and never stoped printing money. Gone are the days of financial discipline. Money Supply M2 in the United States increased from under 100 USD billion 21187.10 USD Billion in October of 2021.

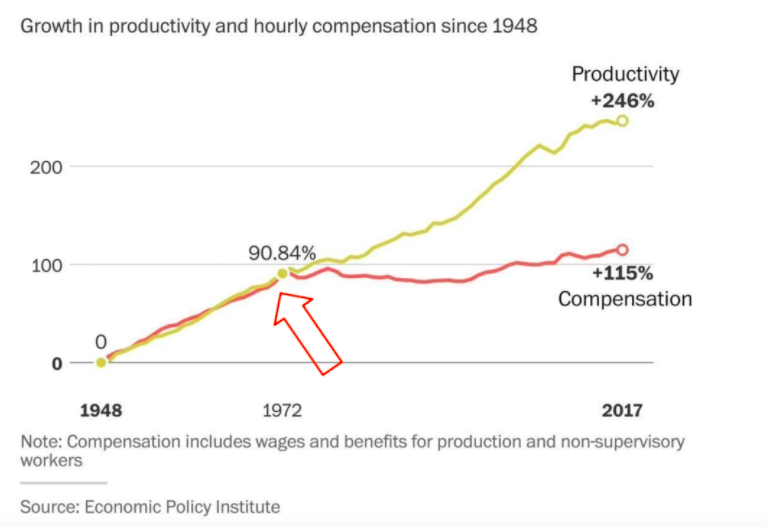

Since 1971 when President Nixxon abandoned the gold standard productivity has grown disproportionate to wages in the US. Whereas productivity hast grown by 246%, compensation has only grown by 115%. This because money, ideally, should be a result of productivity in the market. As a result, wealth is accumulated by those who own companies and assets, but not those, that take part in creating wealth. This is amplified by continuous issuance of new money by central banks and the cantillon effect, continuously widen the wealth gap in society.

Bitcoin, fixed in supply, creates a messaging system of economic truth. The rise in overall productivity will translate into earnings and wages, away from assets like real estate and stocks, creating a much more just and distributed wealth ration. In his essay “Our Most Brilliant Idea” Robert Breedlove has pointed out, how bitcoin, a public utility that facilitates trades of private property is the bridge between capitalistic pragmatism and communist utopianism and could grow to become the super state to which all states ‘bend the knee’. Bitcoin restores economic independence to the individual by giving them an opportunity to store wealth. Working-class people now have a savings vehicle that does not force them to take unnecessary risks or extend their working lives in a race to outpace inflation.

Bitcoins works in line with a broader social-economical change. As explained by Jeff Both is his brilliant essay “Why we need to embrace deflation“, contrary to the the inflation we see in the government currencies, the technology boom of the last decades has actually caused deflation in technology and electronics, which have become cheaper and so has the possibility to use them. At the same time bandwidth and storage capacity has increased and with that, overall productivity in society. The observation is named after Gordon Moore, co-founder of Intel, who proved that historically the number in transistors on an integrated circuit doubles every two years. However, this is not reflected in money. Whilst productivity is rising and tech, the backbone our the economy, has made everything cheaper, wages have been declining in purchasing power. What if the systems that we have used to drive wealth and better living conditions in the past were built around an outdated set of principles ? Both explains:

“We live in an extraordinary time. Technological advances are happening at a rate faster than our ability to understand them, and in a world that moves faster than we can imagine, we cannot afford to stand still. These advances bring efficiency and abundance—and they are profoundly deflationary.” Both concludes:

“Fast-paced technological change has made the conventional thinking on how to drive growth dated and of limited relevance. Rapid innovation, founded on technologies like AI, machine learning and 3D printing, is ushering in a period of massive deflation. Stuff is easier to produce and cheaper than ever. And this phenomenon is just getting started. We’re entering a “technology supercycle” that’s bigger and more powerful than anything we’ve seen before […] Our economic systems were built for a pre-technology era when labour and capital were inextricably linked, an era that counted on growth and inflation, an era where we made money from inefficiency. […] That era is over, but we keep on pretending that those economic systems still work. The only thing driving growth in the world today is easy credit, which is being created at a pace that is hard to comprehend—and with it, debt that we will never be able to pay back. […] We need to build a new framework for our local and global economies, and soon; we need to accept deflation and embrace the abundance it can bring.” (Jeff Booth (2016) “Why we need to embrace deflation“)

As the negative stigmata attached to bitcoin by governments and central banks that fear to lose power is fading, people will understand that the deflation inherent to a system like bitcoin, is the lifebelt for a sinking ship and switch from a fundamentally inferior currency, fiat money, to a superior one, bitcoin. This will be accompanied by a rapid improvement in productivity and wealth (Krawisz, D. 2014).

“In fact, future generations will look back on us today and wonder how, in the name of all that is sane, did we believe the measuring our wealth in a currency or money issued by some overload, that devalued over time, ever made sense. It’s antithetical to the notion of progress and freedom” (A. Svetski).

Continue reading: How Bitcoin uses energy