What is the Bitcoin Lightning Network?

“In the not too distant future, users won’t even know they’re using bitcoin and Lightning, much like users of the internet don’t know they’re using TCP/IP. People will be able to natively and seamlessly send money in any application on the internet, similar to how they can send photos today. Bitcoin can be the protocol that underpins transacting on the internet, from cross-border payments, to payments embedded in chat apps, to gaming and supporting artists and creators. Most of the biggest use cases in the future will be things that would sound insane to us today, kind of like how an encyclopedia that anyone can edit would have sounded crazy to people in the pre-Wikipedia era.” Elizabeth Stark – CEO Lightning Labs.

Bitcoin has served well as a censorship resistance and decentralized store of value, but showed weaknesses as a means of exchange, with low speed and efficiency. As the Bitcoin network grew in value, the Bitcoin blockchain was incapable of handling large transaction volumes. This is because the blockchain is a “gossip protocol”, through which a consensus on everyone’s bitcoin balance is agreed upon. Each node in the Bitcoin network must know about every single transaction that occurs. This created a significant burden for the Bitcoin network to record large amounts of transactions. Initially the Bitcoin blockchain supported less than 7 transactions per second with block size of 1 megabyte. For context, credit card companies can handle more than 40,000 transactions per second. Visa’s payment network achieves to 47,000 peak transactions per second. (Poon, J. Dryja, T. (2016) “The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments”).

To increase Bitcoin adoption, some proposals focused on increasing the block size, as this was believed by some to allow for the confirmation of more transactions at the same time (to dive deep into the discourse I can recommend reading the book “The Blocksize War: The Battle Over Who Controls Bitcoin’s Protocol Rules” by Jonathan Bier). However, the problem with larger blocks is, that it takes away the possibility for average user to run full nodes and therefore creates network centralisation. A Bitcoin full node is a program that fully validates transactions and blocks. Downloading a Bitcoin full node means downloading the complete Bitcoin blockchain. To guarantee nodes are not overwhelmed with data, the Bitcoin blockchain limits the size of blocks and thereby the number of transactions. This allows computers with considerably low computational power to act as full nodes, helping to build a truly decentralized and secure network. It is important to achieve Bitcoin scalability but only while maintaining its intrinsic social-economic value, of which a decentralised network is the most important part. Currently it takes about 350GB memory to download the full Bitcoin blockchain, allowing individual users to run full nodes from home.

Naturally, the Bitcoin Core community dismissed the proposal of increasing the block size. Instead, it was agreed upon that achieving scalability, without creating centralisation, would require conducting transactions of the Bitcoin blockchain. The original idea came from Satoschi Nakamoto, who argued that Bitcoin could achieve “Visa like payment status” with the introduction of a second layer.

On January 14th 2016, Joseph Poon and Thaddeus Dryja co-authored a paper entitled “The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments”, proposing a second-layer protocol on top of the Bitcoin blockchain that achieves scalability by acting similarly to a checking account. “Having fewer validators due to larger blocks not only implies fewer individuals ensuring ledger accuracy, but also results in fewer entities that would be able to validate the blockchain as part of the mining process, which results in encouraging miner centralization”.

The Lightning Network establishes payment channels between users of the Bitcoin network, “aggregating multiple payments into a smaller number of bitcoin transactions. Bitcoin payments are used to set up payment channels, which once set up, can host a flow of multiple payments. Channels can be set up with multiple counter-parties, forming a network of channels. Payments can then find a path along the channels which are directly connected to each other. Bitcoin is the base layer of this monetary system. The Lighting Network represents an improvement in efficiency. It uses a more logic payment structure. Instead of broadcasting a payment to everyone, payments can be sent directly to the recipient.” (Jonathan Bier, “The Blocksize War: The Battle Over Who Controls Bitcoin’s Protocol Rules”)

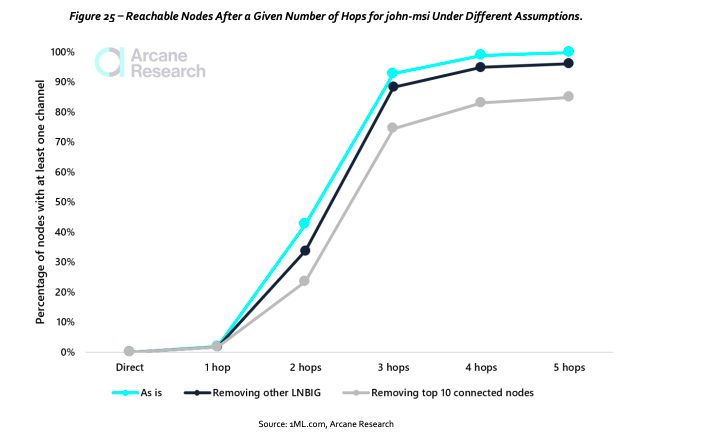

The Lightning Network operate as a mesh network, if there is no direct channel between two parties, a payment may be routed through other existing channels, until it finds its “destination”. The following example is taken from the The State of Lightning by Arcane Research (powered by opennode). To solve the issue of not having a direct payment channel, a user, let’s call him John, has opened a single channel to a well-connected LNBIG.com-node. This node directly has channels with 281 nodes, so in two hops, John can reach 281 nodes, equivalent to 2% of the public nodes with channels. In the next two hops, the net widens. John can theoretically reach 6540 nodes (43%) by two hops, and by the third hop, he can reach 14,049 nodes (93% of available nodes). After this, the growth rate in reachable nodes naturally declines, with John reaching 98.8% after four hops and 99.9% after five hops, reaching practically the entire public network.

The Lightning Network, uses bitcoin’s base layer protocol as its security. The concept of layered money is not new in monetary history. Gold has served as money for millennia due to its unique chemical properties and its global network effects. But gold has not acted as money only in its raw physical form, or on its first layer. The second layer of gold is raw gold that has been melted and shaped into bars and coins. The third layer of gold is gold certificates. The fourth layer of gold is certificates backed by bank-issued gold certificates. Gold is a perfect example of how a layered money system evolves. In his writing “The Time Value of Bitcoin and LNRR” Nik Bhatia uses gold as an analogy to describe why bitcoin will evolve in layers. With the Lightning Network working as a second layer protocol, which uses bitcoin’s base layer protocol as its security.

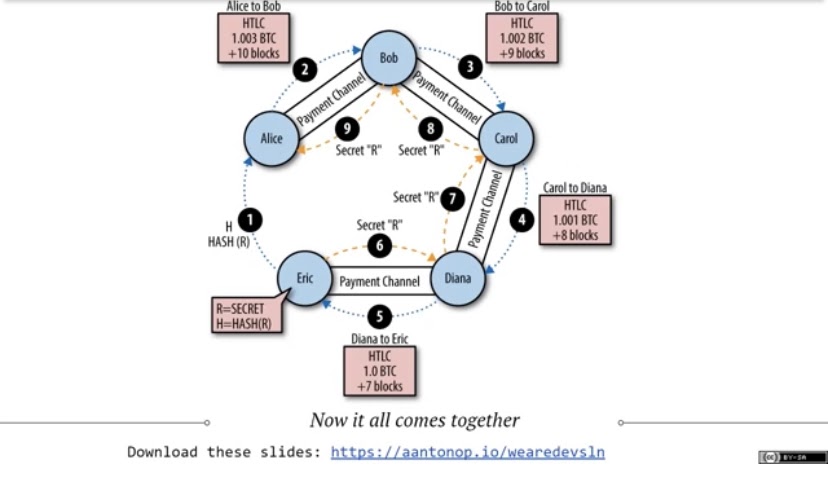

By no means am I a very technical user of Bitcoin nor am I a programmer, but to put it into my own words, the Lightning Network allows to open payment channels and settle micropayments, without having to rely on the Bitcoin blockchain for the confirmation of every single transaction. Instead, the Bitcoin network allows for the opening and closing of Lightning channels. The individual transactions that happen within these channels are governed by the channels. In addition, transactions can be sent to all nodes in the Lightning Network even if no direct payment channel between the two exchanging parties exists. If I want to pay someone I do not have an open payment channel with, the Lightning Network will route my payment through other channels until it finds its destination, this happens fast, within seconds. While this may sound incredibly complicated, it essentially means that transactions can be sent to all nodes in the network via Hashed Time Lock Contracts (HTLCs) even if no direct payment channel between the two exchanging nodes exists.

It is not another blockchain, it is a peer to peer network that operates on top of Bitcoin for fast & cheap transactions. The Lightning network performs the function of making bitcoin a unit of exchange. The Bitcoin network forms the base protocol with its native currency: bitcoin. Payments on the Lightning Network are set in Satoschi, bitcoin’s base unit. 100.000.000 Satoschi are “one bitcoin”. In a way,- the Lightning network sits on top of the Bitcoin blockchain, like PayPal sits on top of the central banking infrastructure (oversimplified example). The Lightning Network is a Layer 2 protocol for Bitcoin. It utilizes Bitcoin’s base layer and protocol to abstract small transactions between users away from the Bitcoin blockchain. With smart contracts, Lightning can settle the final balance of those payment.

The Lightning network is a system of payment channels which are nothing else than the common multisig wallets. To open a channel, the parties create a multisig wallet and send funds to this wallet. The received amount of money becomes the balance of the channel and all subsequent transactions between the participants of the channel are made outside the blockchain. The channel can be closed at any moment by any party. In this case, the last off-chain transaction, determining the balance of the channel, is sent to the network, and invalidate all intermediate transactions because they all use the same output. As a result, we need only one transaction to open the channel and one more to close it, while all the intermediate transactions are made instantaneously, without a record in the blockchain, which makes Lightning transactions more private. The first transaction, determining the balance of the channel, is known as the funding transaction or the anchor transaction. This transaction should be sent into the network and mined to create the channel.

Finally, the channel can be closed both by mutual consent — by sending the closing transaction (settlement transaction) to the blockchain — or by the decision of one of the parties, that would send the last commitment transaction to the blockchain. It allows to prevent a case of one party going offline and ‘locking’ the funds of another party on the channel. During the whole existence of the channel, only two transactions are sent to the bitcoin network and recorded in the blockchain (the funding transaction and the settlement transaction).” (M. Aliev “Lightning network in depth, part 1: Payment channels”)

Consider that all existing payment networks are closed intranets. Lightning Network is the open version. We expect the structure of the Lightning Network to look similar to existing economic network structures but the key difference is that it’s open and permission-less (Jameson Lopp).Because it is an open network, developers can build applications utilizing Lightning. This allows users that do not run their own payment channel to use a Lightning compatible wallet and send micropayments instantly to other users. Check out this video of Jack Mallers doing a Lightning transaction using the Strike wallet, which allows its users to route payments internationally via the Lightning network. To learn more about the practical implementations of the Lightning network listen to Why Bitcoin is Global Money with Jack Mallers.

In term of Lightning adoption, we are only at the start. A tipping point in history, in which the Internet will be complemented by a native currency, as envisioned in the original HTTP (HyperText Transfer Protocol) specifications. “The 402 Payment Required is an error status response code in the HyperText Transfer Protocol that is reserved for future use. Sometimes, this code indicates that the request can not be processed until the client makes a payment. Adoption of the Lightning Network is going parabolic.

In their report “The State of Lightning” Arcane Research explains that “with the introduction of bitcoin as legal tender in El Salvador. As of October 1st, El Salvador President, Nayib Bukele, stated that 2.7 million Salvadorans have been onboarded to the Chivo wallet. The number of Chivo users is not directly equivalent to the same number of active Lightning users. Still, 2.7 million Salvadorans now have access to pay through the Lightning Network on their mobile phones. Other prominent players are enabling Lightning payments as well. Paxful, with a user base of 7 million, announced its Lightning Network integration on September 14th. Further, on September 23rd, Twitter launched a tipping service with Lightning integration, enabling Twitter’s 186 million users to send small tips to each other by utilizing the Lightning Network.”

- For a quick intro I can recommend watching this non-technical introduction to the Lightning network by Andreas Antonopolos

- The State of Lightning by Arcane Research powered by opennode

- You can find a great overview on the Lightning network on bitcoiner.guide

- Jameson Lopp has a great resource list on his website

- You may find this technical introduction to the Lightning network by Andreas Antonopolos helpful

- Lightning network in depth, part 1: Payment channels

- Lightning network in depth, part 2: HTLC and payment routing

- Crash course on how to build on Lightning

PODCAST ON THE BITCOIN LIGHTNING NETWORK

What Bitcoin Did Lightning Series

Mastering Lightning with Andreas M. Antonopoulos & René Pickhardt

Why Bitcoin is Global Money with Jack Mallers

Running a Node with Openoms & Rootzoll

Privacy and Security with Christian Decker & Carla Kirk-Cohen

The Investors Podcast BTC019: Bitcoin’s Layer 2; THE Lightning Network w/Ryan Gentry

Continue reading: Book finished.

If you enjoyed this piece, you can send me a tip to:

⚡ law@getalby.com

Follow me

leonwankum.com

Twitter (X)

Nostr