The Bitcoin blockchain

Satoschi Nakamoto introduced an immutable linear trail of transaction history, he referred to it as a ‘time chain’ and ‘chain of blocks’. Later on, people started to call it ‘blockchain’. The term actually does not appear in the Bitcoin white paper, the a nine-page academic paper that Satoschi submitted to the cryptography mailing list, at all. The technology has existed before Bitcoin. A concept of a cryptographically secured chain of blocks was first mentioned in 1991 by Stuart Haber and W Scott Stornetta (https://www.icaew.com/technical/technology/blockchain-and-cryptocurrency/blockchain-articles/what-is-blockchain/history).

“We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.” (Nakamoto, S. (2009). “Bitcoin: A Peer-to-Peer Electronic Cash System“.)

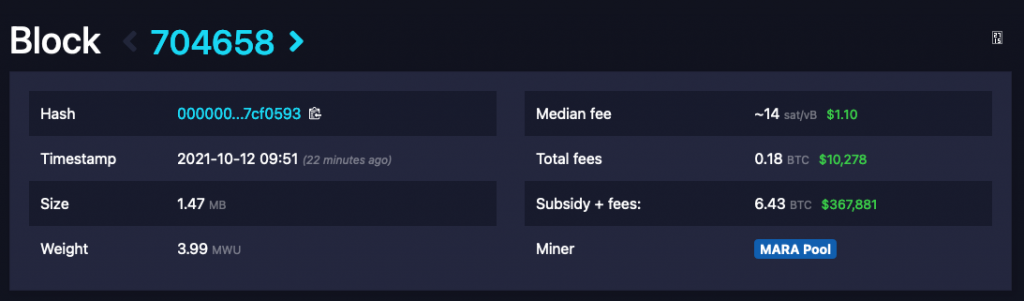

In essence, the Bitcoin blockchain is a transaction database, functioning like an accounting book. Every block in the chain stores bitcoin transactions and bitcoin wallet balances. Together all blocks form a chain of blocks, refereed to as blockchain. A new block consists of new verified bitcoin transactions and includes a hash of the entire existing blockchain stored in the block header. Imagine an accounting book, where a new page is added every 10 minutes. The new page lists new transactions and includes the information of all previous pages in the headline, so that each page represents the entire transaction history. This would safe a lot of paper, right ? Each block in the blockchain is unique and linked to another block through a digital signature.

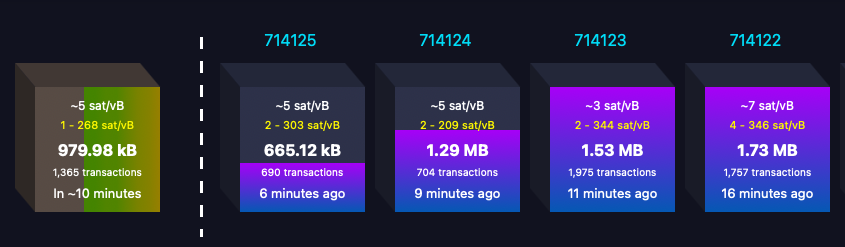

Picture of the Bitcoin blockchain, a transaction database, showing block 714122-714125. The info includes the average fee (paid with every transaction), block size and transaction amount.

On average, every ten minutes a new block is mined and added to the Bitcoin blockchain. The average block size is roughly 1 MB and holds around 2,700 transactions. The Bitcoin block reward, rewarded to the miner who successfully mined the block, currently in 6.25 bitcoin. After a transaction is executed, it gets broadcasted to the Bitcoin network, where it is checked by every network node independently. The transaction then sits in a “waiting area”, called the Mempool (Memory Pool). The transaction waits inside the Mempool until it’s picked up by a Bitcoin miner and inserted into the next block. Whereas a full node, which may be run by any user, is able to verify all transactions from the beginning, a Bitcoin miner creates new blocks in the blockchain which the nodes keep. Miners work on the bitcoin transactions by coming up with the best combination to store that information. Once a new block is added to the blockchain, the information is then stored by nodes, who verify it with other users.

Satoschi Nakamoto was faced with the challenge of creating an accounting structure for the Bitcoin network.

Ledgers are the basis for accounting and can be traced back to ancient times, when the Egyptians used papyrus for their bookkeeping. Other materials used in the past include, clay, stones or paper, however, once computers became widely used, ledgers were digitized. In the 1980s and 1990s early digital ledgers imitated paper-based accounting. Digital ledgers are replacing paper based institutions, but paper based institutions are still part of the norm in our society: money, written signatures, certificates and accounting done by double-entry bookkeeping. Before Bitcoin, such information was always confirmed and stored by a central authority. However, having a privileged central institution creates a social trap, where the individual gives up self-responsibility, in hope for convenience. But no central party will act in the interest of the individual, known as the principal agent problem (Poon, J. Dryja, T. (2016)”The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments”).

The motivation behind creating Bitcoin was to create a digital property with scarcity, trustworthy and independent. It was therefore necessary, to create a shared database for the Bitcoin network, that is not controlled by a single authority. This eliminates the possibilities of cheating. It is a system utilizing a mechanism that is built on game theory, mathematics and cryptography in order to not rely on human control, which minimizes deviations between calculated expectations and reality, thus enforcing the protocol rules: A SYSTEM OF RULES IS SUPERIOR TO A SYSTEM OF RULERS!

The Bitcoin blockchain is a “gossip protocol”, meaning that all modifications to the Bitcoin ledger, hereby all individual transactions, are broadcasted to all network participants. Through the “gossip protocol” a consensus on everyone’s bitcoin balance is agreed upon (Poon, J. Dryja, T. (2016)”The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments”). For example, every Bitcoin user needs to constantly update their history of transactions in order to reflect new bitcoin transactions and wallet balances, it is important that users agree on the same information (consensus mechanism). The architecture of the Bitcoin blockchain goes beyond a simple digital database and beyond static paper-based ledgers. Bitcoin’s achievement is cutting out the cost of trust, which today is guaranteed by central authorities like banks and governments, by creating a network of participants that all store and equally confirm information. The Bitcoin blockchain is the data structure that organizes the information among the Bitcoin network. While this may sound incredibly complex, it is not. Instead of having a central ledger, like an accounting book in a bank, the blockchain is a shared ledger, where information is shared and recorded among many.

Peterson (2017) concludes that Bitcoin’s distributed ledger, implemented through the blockchain, most likely provides the most robust transaction data-set in human history. Every single transaction since Bitcoin’s origin is recorded and publicly available on the blockchain. Distributed across a wide network with an inherently safe validation process, the blockchain is immutable, and therefore its integrity is exceptional.

In theory, blockchain technology is suitable for the organization of a large computer network, where a protocol can attest the accuracy of a trade-off, rather than relying on a third party. Because the Bitcoin blockchain played part in eliminating the need of a central authority for governing the transaction of money and with that removed the social cost of counter-party risk and high transaction fees, a variety or large corporations and banks are investigating use cases for blockchain technology, in order to identify other use cases where blockchain could help eliminating cost. Even though there are a variety of ideas for the use-case of blockchain, so far there has been no long lived use case for blockchain other than money and one should be careful of not falling in the trap of believing that blockchain is the universal answer to all problems.

As German libertarian and Bitcoiner Max Hillebrand very rightfully argues “As with every new technology, in the early stages everyone likes to play Buzzword-Bingo […] . This was true for the Internet with “eCommerce” & “Social Networks”, it’s true for “Artificial Intelligence” & “Machine Learning” [… ] and most definitely this is the case in Bitcoin with blockchain and “Decentralization”. Of course, all those technologies are super interesting and important, but we have to be very careful what they actually can and cannot do. […] … Bitcoin requires a holistic symbiosis of several cutting edge fields, such as cryptography, decentralized network topology, open source development, game theory, incentive structure, [austrian] economics and monetary theory. Bitcoin ONLY works, because of the unique circumstances of it’s creation and the combination of all those vital theories. Blockchain is only a very inefficient data structure that timestamps the transactions.” (Hillebrand, M. (2018). “Why it’s Bitcoin nit Blockchain”)

“Viewing Bitcoin through the lens of time should make clear that the “block chain” — the data structure that causally links multiple events together — is not the main innovation. It is not even a new idea, as is evident by studying the timestamp literature of the past. A blockchain is a chain of blocks.” Peter Todd

Thank you for taking the time to read though this piece, if you have any questions, thoughts or advice, please reach out.

_______

Follow me

Twitter

Instagram