The History of Money & Banking

It is not the task of economic calculation to expand man’s information about future conditions. Its task is to adjust his actions as well as possible to his present opinion concerning want-satisfaction in the future. For this purpose acting man needs a method of computation, and computation requires a common denominator to which all items entered are to be referable. The common denominator of economic calculation is money. Ludwig von Mises

To understand what Bitcoin is, one needs to know what money is and how the administration of money worked in the past. As Carl Menger points out in his book “On the Origin of Money” (1892), money developed naturally out of the shortcomings of the barter economy, in which people exchanged goods and services with one another without using money as a medium of exchange. As humans developed special skills, they created the first types of commodity money, such as jewellry. This made it much easier to trade and store value. As trade routes were built, the need for a universal medium of exchange exceeded the functionality of local commodity money, and the use of precious metals such as gold was introduced because of their universal acceptance. This helped make money more accessible.

Essentially, money is a database for resource allocation with one operation: subtract x units from a and give x units to b. All it takes to implement a working monetary system is to implement this logic. There have been different forms of money throughout history. These have constantly changed and evolved based on the needs and demands of the time and the technological ways to make money to meet those needs and demands. Money has always adapted to the technical state of the art. Smelting technology helped to standardise precious metals and allowed for coin creation. Printing made it possible to issue paper money, certificates and securities. In the 20th century, credit cards and automatic teller machines (ATMs) reinforced the trend towards more electronic money. Bitcoin is the next logical technological step in the evolution of money, introducing a much-needed infrastructure for the direct exchange of value on the internet. As pointed out by Michael Saylor “Money is, and always has been, technology”.

Money is defined as a store of value, a medium of exchange and a unit of account. While different schools of economic thought attach different importance to each function, most agree with these three. The Austrian School of Economics classifies “store of value” as the most important function of money. If money is not a good store of value, then it cannot perform well the other two functions, unit of exchange and unit of account, because no one would accept money in commerce that would depreciate in value in the future. That would be a ‘bad deal’. Also, money that depreciates over time would be a poor unit of account because it would be irrational to value “something valuable” with “something worthless.”

Banking is the administration of money. The history of banking can be traced back to 5000 BC. in the region of Mesopotamia, roughly corresponding to present-day Iraq, Kuwait, eastern parts of Syria, and southeastern Turkey. Written ledgers were used in the temple economy of Mesopotamia to record and control goods, inventory, and transactions (Keith, Robson. 1992. “Accounting Numbers as ‘inscription’: Action at a Distance and the Development of Accounting.” Accounting, Organizations and Society 17 (7): 685–708). The Assyrian Empire and Babylonia were the first to introduce sophisticated banking before it later emerged in ancient Greece and Rome. The Babylonians had auditing systems to check movements in and out of warehouses. This included audit reports as taxation began to create the need for proof of payment. These accounts represent some of the first types of written language.

Cuneiform Clay Tablet found in Babylon, Iraq. Late Babylonian Culture. ca. 350–50 B.C. Written in Akkadian (© The Trustees of the British Museum).

Archeological research has also identified developed bank-like institutions in ancient China and India (Hoggson, NF (1926). Banking Through the Ages. New York, Dodd, Mead & Company.) All of these were sophisticated societies that needed an institution that could offer services such as deposits, loans and other financial instruments. Banking as we know it today can be traced back to Renaissance Italy, which served as the base for growing trade across Europe. As trade expanded geographically, gold became too heavy to ship long distances. So, banks began holding commodity reserves and issuing paper receipts that were used to exchange goods and services.

Today there are modern banks all over the world. They exist in both the private and government sectors, which sometimes makes it difficult to distinguish between the two. Private and state-owned banks work very closely together, and governments often set up national banking infrastructures to make important decisions like interest rates. Banks monitor the flow of money and serve as a source of money, playing an important role in borrowing and lending. They are the backbone of the economy and play a crucial role in financing businesses and enabling economic growth (Frisby, D. (2014). Bitcoin: The Future Of Money?. London: Unbound).

What follows is a brief overview of some of the key developments in the evolution of money and banking to explain why Bitcoin is the next logical step in this evolution. Some of the following facts are already listed in this work, but are placed in a historical context for the sake of completeness.

A short History of Money & Banking

1. Tust

Before the barter economy, trust and favors were the first type of money, with people helping each other or giving each other food. Debt was another form of early money in which individuals received goods or services in return for a promise of reparation, either by returning what they were granted, sometime including some form of interest or by offering physical labor in return.

2. Barter economy

Bartering is the process of coming to an agreement to exchange a good or service for another good or service, without using money as a means of exchange. A barter system eliminates the need for money by having agents trade directly with others. That is, as long as agents are willing to accept a specific product or service for another product or service. Barter does not scale well, as it is impossible to define exchange rates for all types of goods and services in an economy. The shortcomings of the barter economy required better ways to organise trade. To find a common language that everyone can agree on, we use “money”. Money is the most tradable good in a society as a result of having certain properties that make it desirable to own. These properties are scarcity (perhaps the most important characteristic of money, it cannot be easily acquired or produced in large quantities), durability (it cannot be easily destroyed), portability (easily transported), fungibility (one unit of the good should be interchangeable with another of equal quantity) and divisibility (money must be easy to subdivide). As Adam Smith has pointed out in his book “The Wealth of Nations” in 1776, the exchange value of any commodity is most easily estimated in terms of money (Adam Smith, p. 51). There were different kinds of money in different places and at different times.

3. Collectibles & Commodity money

Commodity money, that is, money whose value comes from a commodity it is made of, evolved naturally out of the shortcomings of the barter economy and offered a much more efficient way to facilitate trade. Collectibles such as jewellery were the first known forms of commodity money and have played a crucial role in human evolution. As explained by Nick Szabo “the precursors of money, along with language, enabled early modern humans to solve problems of cooperation that other animals cannot – including problems of reciprocal altruism, kin altruism, and the mitigation of aggression.” (Nick Szabo, 2002. “The Origins of Money“). ‘In the late 1990s archaeologist Stanley Ambrose discovered, in a rock-shelter in the Rift Valley of Kenya, a cache of beads made of ostrich eggshell, blanks, and shell fragments. They are dated to at least 40,000 years old. Pierced animal teeth have been found in Spain also dating to this time. Perforated shells have been recovered from early Paleolithic sites in Lebanon. Recently regular shells, prepared as strung beads and dating further back still, to 75,000 BP, have been found in Blombos Cave in South Africa’ (Nick Szabo, 2002. “The Origins of Money“).

Ostrich-eggshell beads, Kenya Rift Valley, 40,000 B.P. (Courtesy Stanley Ambrose)

Szabo explains that when ‘our modern subspecies had migrated to Europe necklaces of shell and tooth appeared there, from 40,000 B.P. onward. The work is highly skilled, indicating a practice that probably dates much further back in time. The origin of collecting and decorating is quite likely Africa, the original homeland of the anatomically modern human subspecies’ (Nick Szabo, 2002. “The Origins of Money“).

When our ancestors, the Homo sapiens sapiens came to live in Europe, they were not the only human sub-species. We know that the Homo sapiens neanderthalensis lived in Europe at the same time. Archaeological Evidence shows a takeover from the Homo sapiens sapiens in Europe around c. 40,000 to 35,000 B.P, indicating that the population of the Homo sapiens sapiens increased by ten. Not only that, the newcomers had spare time to create the world’s first art, such as cave paintings, a wide variety of well crafted figurines and of course pendants and necklaces of seashells, teeth, and eggshell. Our ancestors the Homo sapiens sapiens had the same size brain, weaker bones, and smaller muscles than the Neanderthals, but still managed to exterminate the Neanderthals. Szabo explains that the biggest difference may have been that wealth transfers were made more effective or even possible with money. It allowed for a better survival and conservation of the species, because bands of families could trade, for example food, with each other during an era when humans lived constantly on the brink of starvation. Homo sapiens sapiens took pleasure from collecting shells, making jewellery out of them and trading them (Nick Szabo, 2002. “The Origins of Money“). The same dynamic would have been at work in the Serengeti tens of thousands of years earlier when Homo sapiens sapiens first emerged in this dynamic maelstrom of human evolution, Africa (Nick Szabo, 2002).

Homo sapiens sapiens’ ability to conceptualize money has enabled him to develop a successful survival strategy in the difficult conditions of human evolution. Money is the basis of our human existence and has played an important role in every culture throughout history. Before established trade routes, the items considered most scarce or having the greatest utility for the local population were adopted as commodity money (Anil, 2021 “FEW UNDERSTAND THIS: A Visual Guide to Bitcoin’s Rise”). Native American money, for example, took many forms, such as shells, furs, and teeth. After people established trade routes, exchange was facilitated by using commodities that were considered scarce across geographic boundaries, such as precious metals, including gold and silver, livestock, salt, and peppercorns.

4. Early coins

As trade across geographic borders increased, the movement of money had to be simplified. Smelting technology made it possible to shape metals that could then be molded into uniform weights and sizes. This served as the basis for coinage, which standardized precious metals into coins of varying shapes and weights, making them easier to transport. Coins also proved more durable than primitive commodity money and were evidence that a great deal of time and effort had been expended in extracting and shaping them. This gave confidence that a sudden surge in supply was unlikely, something that could not be said for shells or teeth (Anil, 2021 “FEW UNDERSTAND THIS: A Visual Guide to Bitcoin’s Rise”).

Around 1000 BC the Chinese developed an intermediate medium of exchange between primitive commodity money and coinage. They used bronze and copper models of cowries, which are shells of sea snails. Cowrie shells can withstand frequent handling and are small and easy to transport. Since they are almost always the same shape and size, they could also be counted or simply weighed to determine the value of a payment. They were accepted in Asia, Africa, Oceania and even some parts of Europe. The Chinese characters for certain words with strong economic meaning (e.g. money, coin, purchase, value) also resemble cowries (citeco.fr, 10000 Years History, Cowry Shells a form of currency).

Cowry shells – Credit: Banque de France

The first real coinage was around 640 BC. in the Kingdom of Lydia, located in the western part of Anatolia in present-day Turkey. The metal used was the naturally occurring electrum, an alloy of gold and silver found in river beds. The main part was made of gold. It’s varying intrinsic value and rarity of its natural occurrence outside of Lydia made electrum coinage a local phenomenon. But towards the middle of the sixth century BC, Croesus (561-546), the last king of Lydia, introduced a remarkable monetary innovation that would have a profound impact on the adoption of coinage throughout the ancient world. The king replaced the electrum coinage with a currency system of pure gold and pure silver coins. Croesus thus established the first known example of bimetallism, commonly defined as a monetary system in which the government defines the value of a currency as being equivalent to specified amounts of two metals, typically gold and silver, with a fixed exchange rate between them (Metcalf, William E. (2016). The Oxford Handbook of Greek and Roman Coinage).

By the middle of the sixth century BC, the Lydians were producing pure gold and silver coins such as the renowned Croesus Stater with a design on one side and punch marks on the other (lbma.com). Trade in Lydia was flourishing, Croesus, the king of Lydia, is said to have possessed unimaginable wealth.

The Worlds first coin – the Croesus Stater. Image provided courtesy of Goldkammer / © Studio Hamm

Eventually the Lydian kingdom was conquered by the Persians under Cyrus the Great in 546 BC., but it’s gold-based monetary system lived on, first in the Persian empire and later in the ancient Greek world around the Mediterranean. The Stater became the most important coin of antiquity and the name Croesus became synonymous with wealth (lbma.com).

These early coins are the first form of currency, which refers to any kind of money in circulation in an economy, used as a means of exchange to purchase goods and services. Currency allows for trade to function more smoothly than through barter or the use of commodity money. Currency is much easier to carry and divide. It is used as a unit of account to quantify different goods and services. Most importantly, currency is considered a store of value. This means that it can be stored and used later on while still retaining most of its value. Inflation describes the process of a currency losing its value. The opposite, deflation, describes how currency increases in value over time.

Money, unlike currency, is an immaterial concept. It can take different forms. It cannot be seen or touched like currency, but seen in terms of numbers, the value it represents. Money can be backed by many things and take many forms. Of these, currency is one form and commodity money is another. Today money is represented electronically. Cash is defined as a form of money in the form of coins and notes accepted at face value.

5. The beginning of paper money

There are various historical accounts of the emergence of paper money, but what we do know is that the first paper money was issued in China. Leather money was used in China in the form of 1 foot pieces of white deerskin with brightly coloured edges around 118 BC. This could be considered the first documented type of banknote (pbs.com). There are also reports of Roman banknotes in the form of a durable light substance, used as promissory notes in AD 57, found between 2010 and 2013 at the site of the Bloomberg Building in the Financial District of London, after which the current Bloomberg Building was constructed on the site of the archaeological dig.

(thereaderwiki.com). A promissory note is a legal instrument (specifically a financial instrument and a debt instrument) in which one party (the maker or issuer) promises in writing to pay the other (the payee) a specified amount of money, either to a fixed or determinable point in time in the future or at the request of the payee under certain conditions (thereaderwiki.com).

The earliest precursor to today’s banknotes was the “Flying Money” used by wealthy merchants and government officials during the Tang Dynasty (618-907 AD) in China. These were documents equivalent to today’s cashier’s checks, allowing a person to deposit money with local officials in exchange for a paper receipt that could be cashed elsewhere for an equal sum of money. This became a popular practice among merchants as it allowed travel without the burden of having to carry copper coins long distances. Flying money could not be exchanged between individuals, nor was it accessible to the general public (guinnessworldrecords.com).

The first known examples of paper money, as we would understand it today, were created in China during the Song Dynasty (AD 960-1279). Promissory notes known as “Jiaozi” were printed by a group of merchants in Sichuan during the reign of Emperor Zhenzong (997–1022 AD), but not out of great financial insight. The sole reason for its introduction was a copper shortage, which hampered the minting of new copper coins. These banknotes were exchangeable for coins and could be exchanged between individuals. This paper currency was initially popular but was plagued by inflation problems after a few decades. Paper money was so easy to make that too much was printed. It was replaced by the notes known as “Huizi”, printed by the government at their own printing plants (guinnessworldrecords.com). Each note was about the size of a sheet of A4 (US letter) paper and consisted of a pastoral scene printed on copperplate with illustrations of coins and a warning to counterfeiters underneath. Printed notes were embellished with a handwritten caption and authenticity stamps in red ink. No examples of the notes survive, although archaeologists have uncovered an example of a printing plate used in their manufacture, dating to around 1023 (guinnessworldrecords.com). In 1455 the Chinese abandoned the use of paper money and did not return to it for several centuries. However, the concept caught on in Europe.

6. The introduction of paper money in Europe

In the 13th century travellers, most notably Marco Polo, introduced the concept of paper money to Europe after returning from Asia (Marco Polo (1818). “The Travels of Marco Polo, a Venetian, in the Thirteenth Century). During this time, cross-border trade in Europe was thriving and it became highly impractical for merchants to travel with large amounts of coins or precious metals. In Italy in particular, banks were established to help merchants protect and manage their funds. The concept of paper money was new to Europe and was adopted in a modified form.

In the 14th century it became a widely used custom for merchants and traders to issues promissory notes. These represented a legally binding financial instrument in which one party promises to pay another party a fixed amount of money the future, sometimes with certain terms or interest payable. Banks held the actual money, usually in the form of precious metals such as gold or silver. Merchants could travel more freely without having to carry large sums of money. Holders of promissory notes had the right to collect money from the bank. This originated the term banknote from the Italian (“nota di banco”). A banknote in the 14th century did not mean what we understand as a banknote today, but represented a cheque-like debt instrument, allowing its owner to collect money in the form of precious metals (Wikipedia: History of Money).

6.1 The development of paper money in Europe

In the 17th century, the concept of fiat money was born when a Latvian-born Dutch banker named Johan Palmstruch, who lived in Stockholm, introduced the concept of banknotes denoting their value not from precious metals pledged as collateral, but from the promise of a Bank to pay out the value of a bank note on request. Therefore, fiat money is also referred to as fiduciary money (from Latin: fidere = ‘to trust’ ).

Palmstruch had moved to Stockholm from Amsterdam when he was young. He was the descendant of a successful merchant in Amsterdam and was familiar with the successful Dutch banking system. His connections enabled him to get into contact with King Charles X Gustav of Sweden, who wanted to modernise the Swedish financial system. Private banks already existed in several cities across Europe, but what the Crown desired was one owned and controlled by the state (John Calloway, spink.com; 2022). Palmstruch suggested opening a bank and helping out. In 1656 Charles X Gustav of Sweden authorised Palmstruch to set up the Stockholm Banco in exchange for 50% of the profits.

At that time trade was thriving in Sweden, but the financial system was not advanced. Sweden’s currency, the Daler, was unstable and unhandy. Precious metals, mainly copper, were used as the monetary standard. Sweden, as Europe’s leading copper producer, had adopted this metal as its currency due to its limited access to gold and silver used by other countries (John Calloway, spink.com; 2022). Silver coins of much higher value were also in circulation. This caused problems as the value of copper fluctuated more than the value of silver, resulting in currency discrepancies. In addition, the Daler was issued in large plates, sometimes weighing several kilograms, which made transport difficult and did not allow the currency to be broken down into enough denominations to be used for small transactions.

A Swedish copper plate coin, 1/2-daler, King Karl XII, 1718. Source: Bukowskis Auction.

To solve the problems, Palmstruch set up a banking system similar to that in other European commercial cities such as Hamburg or Amsterdam. Stockholm Banco offered the service of securing the cumbersome metal plates that were kept in the bank’s custodial vaults. Customers received a receipt that could be used as money, and the bank charged a commission for the service. The idea was not new overall, but it was new in Sweden and removed the burden of having to carry around heavy copper plates, which helped generate exponential demand for the bank’s services.

Palmstruch had a “financial insight” over time, observing that the deposited metals remained in the vaults unclaimed for long periods of time. So he came up with the idea of issuing credit and loaning them to businesses. After a while, the bank transitioned from a place that secured funds and helped with commerce to a lending institution that leveraged unused customer deposits. At first, this was a great financial success, and the interest earned helped the bank to grow and trade with it in Stockholm. However, when King Charles X Gustav died in 1660, the crown decided to mint new copper plates, worth less than the old ones. New plates were made weighing about 83% of the old ones. Customers rushed to the bank to withdraw their old deposited plate money, because this could now be melted down for a profit. This became a problem because a large part of it was on loan (John Calloway, spink.com; 2022).

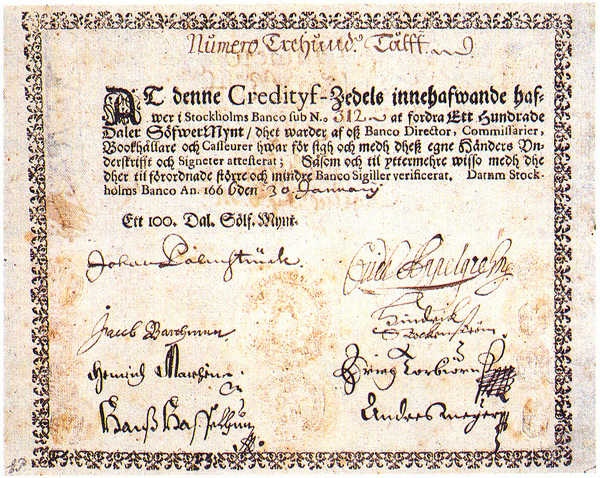

Palmstruch then suggested decoupling the issuance of receipts or banknotes from the deposited metals. The crown agreed and the concept of fiduciary money was born. From that moment on, the bank itself was the only guarantee for the banknotes issued by Stockholm Banco. No metals were used as collateral. The notes were called Kreditivsedlar. The bank was the first bank in Europe to issue non-personal banknotes that could be exchanged with anyone for any type of good or service. The banknotes promised the holder future payment for the amount marked on them in gold and silver coins, to be collected from Stockholm Banco. At first, this boosted the economy in Stockholm and Sweden. There was a local confidence that the bank was able to guarantee the stability of the new currency. But the new prosperity brought along unknown problems. The excess of liquidity caused something the Swedish economy had never seen before: inflation.

The first paper money in Europe, the Kreditivsedlar issued by the Stockholms Banco in 1666. Source: http://www.alvin-portal.org/alvin/view.jsf?pid=alvin-record%3A47808&dswid=740

Palmstruch steadily increased money supply, and the price of everything went up. After some time, the bank decided to cut credit and reduce the amount of money in circulation. This caused a financial crisis as people were now faced with a liquidity squeeze, that caused an economic depression in Sweden. Suddenly, customers lost confidence in the bank and demanded their deposits and payments in metal. However, the bank had issued more notes than they had metal deposits to redeem and was not able to honour its commitments.

Unfortunately, a fundamental fact of banking life has not been taken into account by Johan Palmstruch: taking short-term deposits to fund longer-term borrowing could quickly create a liquidity problem for the bank if those deposits were withdrawn in the short term. Banks have ignored this fundamental fact of banking for decades and centuries to this day (John Calloway, spink.com; 2022).

In 1667 the Stockholm Banco went bankrupt, Palmstruch was sentenced to death, finally pardoned and put in prison. After the economic shock caused by Pamlstruch, the Swedish parliament decided that a national bank was necessary. In 1668 Palmstruch was stripped of his privilege to run a bank, which was transferred to another institution called Riksens Ständers Bank, later renamed to Sveriges Riksbank or the Bank of Sweden, which remains the central bank of Sweden to this day and as such is considered the oldest central bank of the world. The Sveriged Riksbank became the sole issuer of banknotes. The concept of a central bank caught on and was adopted in various jurisdictions across Europe and North America.

Chapter reference: Boudeguer, R.M (2015). “The first central bank in history and its banknote printing machine”. Available Online: http://www.bancamarch.es/recursos/doc/bancamarch/20150105/201592472/informe-mensual-noviembre-2015-historia-en.pdf).

7. Establishment of central banks

In the 17th century, nation states began to emerge in Europe. Scholars consider the founding of the English Commonwealth in 1649 to be the earliest example of the emergence of a nation state. France after the French Revolution (1787–99) is often cited as the first modern nation state (Yuval Feinstein, britannica.com). As a political model, the nation-state combines two principles: the principle of state sovereignty, first articulated in the Peace of Westphalia (1648), [the collective term for two peace treaties that were concluded in October 1648 in the Westphalian cities of Osnabrück and Münster. They ended the Thirty Years’ War (1618-1648) and the Eighty Years’ War (1568-1648) and brought temporary peace to Europe*], which recognizes the right of states to govern their territories without outside interference; and the principle of national sovereignty, which recognizes the right of national communities to govern themselves (Yuval Feinstein, britannica.com).

Before the 17th century, there was no nation state in Europe as we know it. Back then, most people didn’t consider themselves part of a nation; They rarely left their village and knew little of the larger world. If anything, people tended to identify with their region or local lord. At the same time, the rulers of the states often had little control over their countries. Instead, local feudal lords held much power, and kings often had to rely on the goodwill of their subjects to rule. Laws, practices and currencies varied greatly from one part of the country to another. There was no central body tasked with overseeing a country’s finances and spendin. For example, paper money issued in China from the 11th to the 13th centuries was not issued by a bank but by the emperor’s treasury. In the early modern period, some monarchs began to consolidate their power by weakening the feudal nobles and allying with the emerging merchant classes. This difficult process often required violence, as kings and queens worked to bring all the people of their territories under unified rule (sparknotes.com). Central banks were established, tasked with issuing money and credit to control the monetary system and fund war efforts.

Banks had existed in Europe for at least three hundred years, with the first appearing in Florence in the 14th century. Lombardy in northern Italy, with Florence at its heart, became home to several leading banks and the wide reach of their operations gave their name to Lombard Street in the heart of the City of London (John Calloway, spink.com; 2022). Founded in 1472, Banca Monte dei Paschi di Siena survives to this day as the oldest continuously operating bank in the world after more than 540 years in business, but as the Lombards declined, as their political supporters faded, so did the power of their associated banks and the Fuggers of Augsburg rose on the back of the spread of the vast Habsburg Empire (John Calloway, spink.com; 2022). Banking in its early days was essentially a case of wealthy merchants lending to kings and queens, this is for example how the Rothschild Family made their fortune. This changed as monarchs consolidated their power and began using banks as a means of funding their political campaigns. Not surprisingly, then, nationalism emerged with the birth of the nation-state, as monarchs encouraged their subjects to show loyalty to newly established nations. Wars broke out between the major nation-states, particularly between the great powers France and England, who fought for supremacy in Europe. In 1694 the Bank of England was established to raise money for King William III’s war against France.

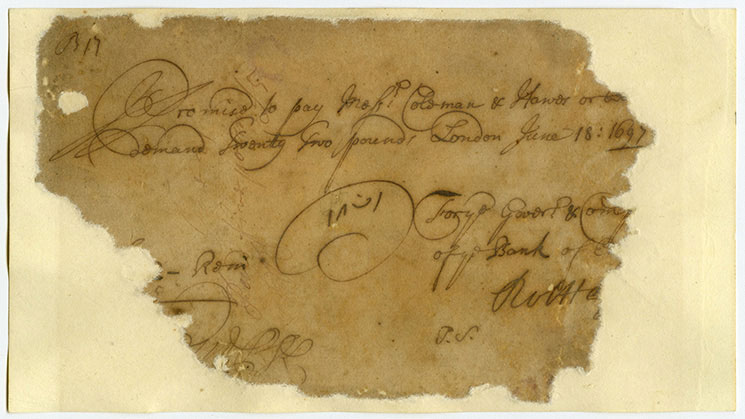

Sophisticated banking began to develop in England in the early 16th century, where goldsmiths acted as bankers and began taking deposits, lending and creating money (Kim, 2011). These early bankers gave paper receipts for deposits, mostly gold coins. These receipts, known as “running cash notes” promised to pay out the deposit on demand and functioned like banknotes (“nota di banco”) in Italy. The notes could be redeemed by anyone presenting it for payment. This handwritten fragment is one of the earliest known examples. It promises to pay the bearer £22, which means it could be exchanged for that value of gold. As the inscription shows, the deposit was withdrawn in two payments (£5 and £17).

Running Cash Note ca. 1697. Source: Bank of England Museum. Available online: https://www.bankofengland.co.uk/museum/online-collections/banknotes/early-banknotes#:~:text=Running%20cash%20notes%20were%20the,for%20that%20value%20of%20gold

The Bank of England institutionalised this practice. By issuing promissory notes against hard currency, England was able to raise money to funds its war effort against France. Citizens were promised that their hard currency would be guarded and used the paper bills as a means of exchange.

Next, England’s rival France set up a central bank. By the end of the 18th century, the upheavals of the French Revolution had caused hyperinflation in France. Believing that more paper money would bring more wealth and thereby boost the economy, the French National Assembly printed paper money en masse (Steir, 2016). Paper money was fairly new and no one understood the dangers of it. All previously used forms of money, such as precious metals or checks linked to precious metals, were limited in quantity. The French government therefore believed that printing more money would not diminish its value but would create more wealth overall. Just as adding more gold to an economy generally creates more wealth. That was a mistake. At some point, the ink needed to print money cost more than the banknotes themselves (Steir, 2016). In 1800 the Banque de France was founded by Napoleon Bonaparte to stabilize the monetary system. Napoleon wanted to restore confidence in the French banking system. Funds were also needed to support the ongoing war with England and fighting on French soil. The bank listed among its founding shareholders Napoleon Bonaparte, members of his family, and several leading personalities of the time. The bank was initially granted the exclusive privilege to issue bank notes in Paris for a period of 15 years. In 1946 the bank was nationalized, and its note-issue privilege was extended for an indefinite period (The Editors of Encyclopaedia Britannica).

Both France and Britain were economic and cultural superpowers at the time. The idea of creating a central bank tasked with overseeing finance, credit and money creation has caught on in other parts of the world. Central banks were later established around the world for similar purposes. Legal tender was introduced to define what money must be accepted by courts to settle monetary debts, e.g. to settle government tax debts. The Reichsbank, which was the central bank of the German Reich from 1876 until 1945, was founded on January 1, 1876. The Bank of Japan was established under the Bank of Japan Act, announced in June 1882, and began operating as the country’s central bank on October 10, 1882. The Federal Reserve System in the US was established in 1913 when President Woodrow Wilson signed the Federal Reserve Act. The idea was to create a somewhat decentralized central bank with regional locations to balance the competing interests of private banks (federalreserveeducation.org).

As the central financial authority of their respective jurisdictions, central banks held other banks’ deposits, facilitated interbank transactions, and provided other banking services, thus becoming the banks of the bankers. The concept of centralizing this task and giving sole responsibility to centralized institutions increases the risk of inflation. This is because central banks tend to overprint money or make mistakes while trying to regulate the economy. Something central banks have been doing since their inception. In 1696, the British government under King William III. experienced a financial crisis when they tried to replace the existing silver coins used in the economy with new ones. The coins were withdrawn because they had lost value through years of use. The government took old damaged coins by weight rather than face value. This hurt owners of old coins financially, as most were trimmed on the sides and therefore weighed less. Another Great Recoinage followed in 1816, when the Bank of England suffered massively from overspending in the Napoleonic Wars against France, a country that had recently experienced hyperinflation itself. This financial turmoil required some kind of standard to give national currencies an underlying value and prevent crises.

*Clodfelter, Micheal (2017). Warfare and Armed Conflicts: A Statistical Encyclopedia of Casualty and Other Figures, 1492–2015. McFarland. p. 40.

8. The gold standard

The gold standard was introduced as a mechanism to give an underlying value to currencies issued by central banks. Each country fixed the values of national currencies to predetermined amounts of gold. Central banks held large reserves of gold to ensure their banknotes could be converted into gold at any time. The idea was that this would give currencies an underlying value and force central banks to exercise discipline. England was the first nation to officially introduce a gold standard in 1821. Sir Isaac Newton had already unofficially adopted it in 1717 as master of the Royal Mint at the time, when he set the exchange rate from silver to gold too low and thus caused silver coins to go out of circulation. Germany adopted the gold standard soon after its unification in 1871. The US followed and the gold standard was adopted internationally.

The gold standard worked very well as long as any state that professed to use it acted honestly. Its major flaw was that some nations tended to cheat and print more money than the amount of gold they had in their reserves. Before the outbreak of World War I in 1914, Germany, England and the USA had been overspending and were forced to depeg their currencies from gold as they did not have enough gold to pay for their war preparations and follow-up costs.

By changing the monetary system, the major European powers could print money and wage war with high deficits. After the war, this led to devaluation of national currencies and hyperinflation as central banks continued to print money to pay off debts. In some places, for example in Germany, the value of national currencies fell so much that people needed wheelbarrows full of cash just to buy a loaf of bread (Antonopoulos A,M. (2015). Mastering Bitcoin: Unlocking Digital Cryptocurrencies. Sebastopol: O’Reilly Media, Inc.).

After the war ended, some countries, including the US, England, South Africa and Australia, returned to the gold standard. But troubles continued, especially in the United States. After the 1929 stock market crash, investors became heavily involved in foreign exchange, commodity trading, and gold hoarding. This drove up the price of gold, leading people to exchange their dollars for gold, which devalued the US dollar.

The same year, the Federal Reserve raised interest rates to make the dollar more valuable and discourage people from further withdrawing US gold reserves. Unfortunately, higher interest rates made the Great Depression worse by increasing the cost of doing business. This caused many companies to go bankrupt.

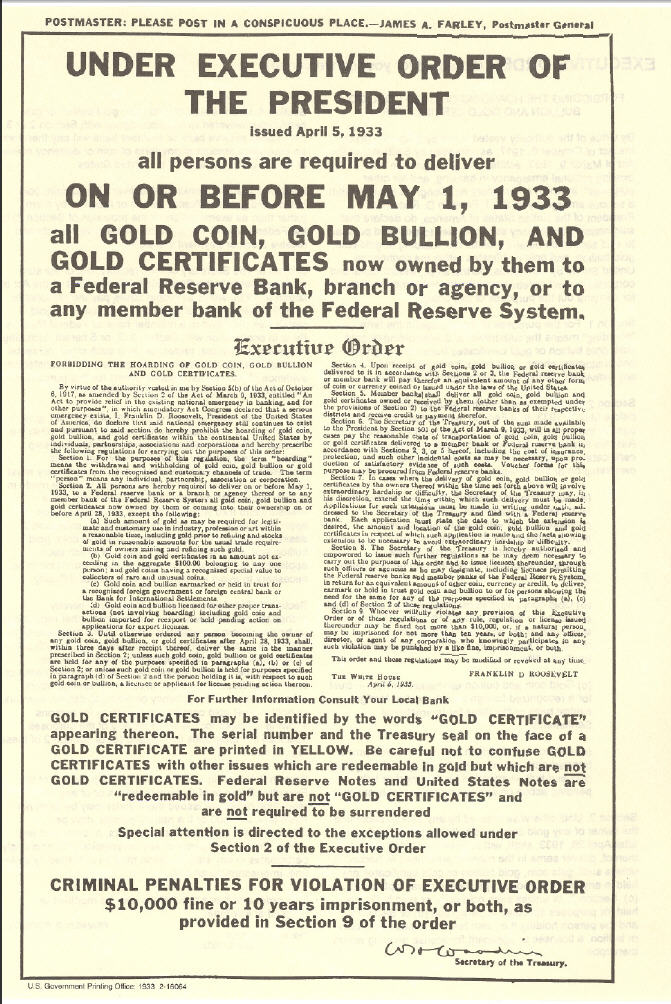

On March 3rd 1933, President Roosevelt ordered all banks to close on the condition that they surrender all their gold to the Federal Reserve by the time they reopen on March 13th. Shortly after, on April 5th, President Roosevelt signed Executive Order 6102, which mandated all American citizens to turn in their gold reserves in exchange for paper notes and forbade ownership of quantities of gold worth in excess of $100. Citizens were required to deliver all gold, including coins, bars and gold certificates, in excess of the allowable quantity to the Federal Reserve by May 1st at a set price of $20.67 per ounce. As a result, the government took $300 million worth of gold coins and $470 million worth of gold certificates. This created the gold reserves at Fort Knox.

Executive Order 6102

The following year, on January 30th 1934 President Franklin D. Roosevelt signed The Gold Reserve Act, which required all gold reserves held by the Federal Reserve to be handed to the US Department of the Treasury. The Gold Reserve Act also prohibited anyone from redeeming dollar bills for gold, putting a provisionally end to the gold standard in the USA. The Treasury Department was authorized to control the value of the dollar without Federal Reserve approval, and the President was authorized to determine the gold value of the dollar.

Immediately after the passage of the law, President Franklin D. Roosevelt raised the price of gold from $20.67 an ounce to $35. This rate reduced the dollar’s gold value to 59 percent of the value set by the Gold Act of 1900, which was $20.67 per troy ounce. The government also set up the Exchange Stabilization Fund (ESF) to buy and sell gold, foreign currency, securities and other financial instruments to control the value of the dollar and conduct open market operations without the support or approval of the Federal Reserve (G. Richardson, A. Komai and M. Gou, 201).

During the confusing years of World War II beginning in 1939, nations moved on and off the gold standard to fund their war effort as needed. Toward the end of the war, in 1944, a modified gold standard was reinstated under US leadership.

9. The Brenton Woods agreement

From June 1-22, 1944, just before the end of World War II, 44 allied nations, led by the United States, met in Bretton Woods, New Hampshire. The intent of the US and its allies was to establish rules for an international monetary system, leading to the Bretton Woods Agreement. By the end of World War II, the United States held about three-fourths of the world’s gold supply, and as a result, a pure gold standard had become obsolete. Instead, the US proposed that all allied countries’ currencies should be pegged to the US dollar. The dollar, in turn, was linked to the price of gold. The value of the dollar was fixed at 1/35th of an ounce of gold. The conference established the US dollar as the world reserve currency, replacing a pure gold standard. The idea of the Bretton Woods system was to give nations more flexibility than strictly adhering to the gold standard, while offering less volatility than a standardless monetary system and establishing the United States as the central monetary authority (federalreservehistory.org)

The International Monetary Fund (IMF) and World Bank were founded at the conference with a vision that they would rule the US-led global financial regime and support the monetary interests of the US. Both institutions were established during the 1944 Brenton Woods Conference to provide loans and financial assistance to developing countries and receive most of their funding from the US government. As the largest shareholder, the United States has its own seat on the IMF’s Executive Board, and with 17.43% of total voting power, the United States has veto power over major policy decisions (Congressional Research Service, 2022). Furthermore, to become a member of the World Bank, a country must first join the International Monetary Fund (IMF), and the World Bank President comes from the IMF’s largest shareholder, the United States. “Traditionally, the President of the World Bank has always been a US citizen appointed by the United States.” (worldbank.org “The World Bank in the United States.”).

As the United States became the world’s dominant economic power, it effectively began to control the global financial system. Under the agreement, the allied partners pledged that their central banks would maintain fixed exchange rates between their currencies and the dollar. The allied nations agreed that if a country’s currency value became too weak relative to the dollar, the central bank would buy up its currency in the foreign exchange markets to reduce the currency’s supply and increase its price. When a country’s currency became too strong, the bank would print more and increase supply to lower the price of the currency.

As the dollar became a substitute for gold, the value of the dollar began to appreciate relative to other currencies. This led to increased demand even though the dollar’s value in gold remained the same. As a result, the dollar became overvalued. This caused problems for the US government. With the US interested in exporting goods and services to its allies and other nations around the world, the overvalued US dollar was bad for business. The US had also spent too much money on foreign military programs, particularly in Vietnam. A gold standard meant the Federal Reserve was limited in its ability to create dollars. By 1970, the US ran out of gold to back its foreign dollar holdings and faced a serious liquidity crisis.

On August 15, 1971, President Nixon announced that the United States would end the convertibility of the US dollar into gold, effectively ending the Bretton Woods system and making the dollar a fiat currency. The “Nixon shock” ushered in a new era in which central banks began operating a fiat-money-based system with floating exchange rates and no currency standard (history.state.gov).

10. The establishment of fiat money

“Fiat Money” (from Latin: fiat =“let it be done”) is a type of money that derives its value entirely from government regulation and is not backed by commodities such as gold. Governments create fiat money ex nihilio, out of nothing. Its value does not derive from the material it is made of or the resource on which it is based, but from the value it represents depending on the economy in which it is used.

Fiat money has value because (a) the government says so and (b) people are willing to accept it for payment. People are willing to accept fiat money because they know from experience and insight that everyone else in society will also accept that money (Rothbard M.N. (2019) “What Is The Free Market?”). Put simply, fiat money is legal tender whose value as a currency is determined, and consequently regulated, by an issuing government (corporatefinanceinstitute.com, 2022).

With the end of the Brenton Woods Agreement in 1971, the world economy abandoned the gold standard and ran solely on a fiat money-based system with floating exchange rates. It is the longest period in history that the global monetary system has functioned without any sort of standard that gives national currencies an underlying value. It is a key feature of fiat money that, unlike gold, it is inherently worthless. Governments, along with central banks, use fiat money to control the economy. Fiat money gives the government full control over inflation, the flow of money and its value. The indiscriminate control that central banks exercise over our money has become increasingly evident during lockdowns amid the coronavirus “pandemic” that has crippled economies around the world. With the economic damage mounting, central banks sought to create new productivity by injecting new liquidity into the market, hoping that this would lead to stability and growth. Unfortunately, the opposite was the result. Excess money supply causes inflation, the loss of purchasing power of money, which reduces the purchasing power of the average household and leads to economic instability. In the past, high inflation has often led to civil unrest and political turmoil. This was most evident in the rise of populism and totalitarianism in Europe during the post-World War I inflationary regime of the 1920s and 1930s (Ray Dalio, How The Economic Machine Works).

In February 2022, US annual inflation rose to 7.9%, the highest level since January 1982. Similar developments can be observed worldwide. Europe, China, Russia, large parts of South America and Africa are also affected by high inflation. This has led to a deterioration in economic conditions. The average household’s savings are falling in value while the prices of rent, groceries and goods are rising. Bitcoin will help offset these societal disruptions over the long term as it is a way for people to store value outside of the traditional financial system. Bitcoin was designed with the aim of providing a solid monetary base that cannot be arbitrarily inflated by a central bank, to allow households to accumulate and store savings independently of central banks and take that value with them when they need to move, albeit at the cost of fairly high volatility.

Despite the termination of the Brenton Woods Agreement in 1971, the US dollar remains the world’s dominant reserve currency. The United States, five US territories and seven sovereign countries use it as their official exchange currency, while more than 65 countries peg their currencies to the US dollar.

11. Petrodollar system

When President Nixon announced that the dollar could no longer be exchanged for gold, the US had to find another way to create demand for the dollar. Because the US wanted to ensure that the US dollar remains the global reserve currency in order to be able to continue to exercise control over the global monetary system. This led to the creation of the petrodollar system in 1974, in which the US and Saudi Arabia, the world’s largest oil exporter, agreed to fix oil prices in US dollars. That meant any country buying oil from the Saudi government had to convert its currency to US dollars before the sale was complete. In return, the US gave security guarantees to Saudi Arabia. Since then, Saudi Arabia has officially quoted its oil price in dollars, no matter which country is buying (Summer Said, Stephen Kalin; Wall Street Journal, 2022).

This prompted the remaining OPEC (Organization of Petroleum Exporting Countries) countries to price their oil in US currency and follow suit. OPEC was founded in Baghdad on September 14, 1960 by the five founding members Saudi Arabia, Iran, Iraq, Kuwait and Venezuela (OPEC.org). As of September 2018, the 13 member countries accounted for an estimated 44 percent of global oil production and 81.5 percent of the world’s known oil reserves. This gives OPEC major leverage over global oil prices, previously set by the so-called “Seven Sisters,” a group of multinational oil companies including BP, Shell and Standard Oil (Colgan, J. D. 2021). Petrodollars are the main source of income for many OPEC members and other oil exporters. The word “petro” stands for petroleum (oil). Petrodollar refers to the fact that an exchange of oil for US dollars takes place between countries that buy oil and those that produce it. The petrodollar system allowed the US dollar to remain the world’s reserve currency despite the end of the Bretton Woods Agreement.

OPEC members use the excess dollars they have from oil sales to buy US Treasury bonds. Treasuries are government bonds where the lender lends money to a government that promises the money will be repaid at a fixed rate in the future. US Treasuries are considered the best risk-adjusted debt instrument due to a low probability of default by the US government as the obligor. Demand for US Treasuries is one of the US government’s most important sources of liquidity, and their worldwide use as a store of value makes the US dollar, among other things, the global reserve currency.

To date, the US dollar accounts for about 80 percent of global oil sales (Summer Said, Stephen Kalin; Wall Street Journal, 2022), 60 percent of the world’s foreign exchange reserves and outstanding international debt, 55 percent of cross-border bank lending, and more than 40 percent of the world’s Foreign Exchange and Commercial Transactions. Because of the US government’s dominant role in the global monetary system and the currency’s heavy use, money earned in US dollars has historically been considered a safe haven and ultimate store of value (Mueller,H 2022). There are trillions of dollars in foreign exchange reserves. China alone holds over $1 trillion in US dollar reserves. It is the country with the largest foreign exchange reserves held in dollars (Lyn Alden, 2022).

More recently, however, the balance of global economic power has shifted from the United States and Europe to China and several other rapidly developing countries. These economies account for an increasing share of global GDP, production and trade, and these shifts are being driven by increasing economic integration and interdependence between economies. This is particularly due to global production and supply chains involving inputs from many different countries. Associated with these shifts is a significant expansion of trade and global value chains between developing countries (South-South trade), which are processed in local currencies (Congressional Research Service, 2022). China has positioned itself as a major bilateral development lender for infrastructure projects in developing countries, especially in Africa, and could build international economic institutions and financing arrangements aimed at replacing existing US-led institutions in the long term (Congressional Research Service, 2022).

In addition, alongside the dollar, the Chinese yuan is increasingly being used in international trade. On March 15, The Wall Street Journal reported that Saudi Arabia had said the country was willing to accept yuan for Chinese oil sales. The Saudi kingdom is increasingly dissatisfied with what it feels is a lack of support from the US government on foreign policy matters, including the US’s lack of support for Yemen’s civil war and its efforts to sign a nuclear deal with Iran. China buys more than 25% of the oil that Saudi Arabia exports. If priced in yuan, these sales would further boost the Chinese currency (Summer Said, Stephen Kalin; Wall Street Journal, 2022).

Shortly thereafter, on March 23, Russian President Vladimir Putin said that Russia would demand payment in rubles instead of euros and dollars for gas sold to “unfriendly” countries (Nina Chestney; Reuter, 2022). After invading neighboring Ukraine on February 24, 2022, Russia fell out of favor with the international community and was hit with massive sanctions. On February 26, 2022, US President Joe Biden, in a joint statement with leaders of the European Commission, France, Germany, Italy, the United Kingdom and Canada, announced the seizure of foreign exchange reserves of the Central Bank of Russia totaling 630 billion US dollars (European Commission, 2022).

“We, the leaders of the European Commission, France, Germany, Italy, the United Kingdom, Canada, and the United States condemn Putin’s war of choice and attacks on the sovereign nation and people of Ukraine. We stand with the Ukrainian government and the Ukrainian people in their heroic efforts to resist Russia’s invasion. Russia’s war represents an assault on fundamental international rules and no that have prevailed since the Second World War, which we are committed to defending. We will hold Russia to account and collectively ensure that this war is a strategic failure for Putin” (European Commission, 2022). China remains the only major issuer of foreign reserves that hasn’t cut Russia off (Gordon, N. 2022).

The decision heralds a new geopolitical epoch. Regardless of what one thinks of the decision, this was the most aggressive move to weaponize the US dollar system in history. Previous sanctions have focused on the assets and liabilities of affected individuals and institutions. Central bank assets have never been targeted. This will undermine the US dollar’s nature as a global reserve currency, as it could prompt other foreign powers to sell their US Treasuries over fears that the US government could freeze their reserves for political reasons in the future (Nic Carter, 2022).

With the confiscation of the foreign reserve assets of the Central Bank of Russia, the petrodollar system ends. We face a reality where the shift in geopolitical power will lead to the emergence of a multitude of world reserve currencies and weaken the dollar’s position. The political landscape is becoming multipolar in many ways (Lyn Alden, 2022). In a world where foreign asset accumulation is seen as risky, military and economic blocs will continue to drift apart (Jon Sindreu, 2022).

Central banks will likely reconsider their reserve practices and switch back more to gold as a reserve asset while also focusing on maintaining larger inventories of industrial/agricultural commodities. Scarce commodities that are physically within the jurisdiction of the country cannot be sanctioned or frozen. We are witnessing the birth of a new (monetary) world order centered on commodity-based currencies in the East, which are likely to weaken the dollar system (Zoltan Pozsar, 2022). The change has not gone unnoticed by the US government. On March 2, 2022, Fed Chair Jerome Powell publicly stated that there was room for multiple reserve currencies, including cryptocurrency (Brooke, O. 2022).

The properties associated with bitcoin make it an ideal reserve asset. The supply is finite. There will never be more than 21,000,00. It is easily portable, divisible, durable, fungible, censorship-resistant, and non-custodial. A central bank can set up its own cold wallet (a device that stores cryptocurrency offline) and protect its bitcoins from the threat of sanctions. It is a purpose built money for the digital age — permissionless, open-source, sound and global. Bitcoin is easy to buy, store and sell. High in liquidity and tradable 24/7. It is digital gold. These characteristics make it an ideal asset for a central bank, as reserves are designed to give a central bank the ability to defend the currency at all costs (McLellan, 2022).

Would this make bitcoin a tool for despots to evade sanctions? Possibly, but that’s not bitcoin’s fault, the technology is neutral. It doesn’t respond to politics. The Bitcoin network simply runs software code. Like any other tool, say a phone or a knife, bitcoin can be used to do good and evil, but at its core the technology is neutral. Bitcoin matters because the technology sets fair rules. The Bitcoin network is decentralized and distributed across thousands of computers around the world. No single entity can ever control it. This is important because it creates a financial system that is inclusive and widely accessible. A system of rules without any rulers.

Today the US controls the global monetary system and tomorrow it could potentially be China, a communist dictatorship actively subverting liberal values. This has been evident in their attitude towards bitcoin. The Chinese government has made several attempts to attack the Bitcoin network. When it banned bitcoin last year, China did so in different phases. First, the country banned financial institutions from all bitcoin transactions in May. Then, in June, it banned all domestic bitcoin mining, and finally, in September, it banned cryptocurrencies entirely (Quiroz-Gutierrez, 2022).

The decentralization of is a threat to a government that wants to have full control over the flow of capital. Bitcoin does not allow for control by a central institution. It is revolutionary because it’s property that’s truly owned. Unlike other forms of property, it is very difficult to confiscate. The absolute ownership of value that we have in bitcoin is unprecedented and cause for great hope, particularly as inflation and confiscation rise (Jimmy Song, 2022).

Commodities and mineral resources have historically served as the basis of our monetary system and have fueled much of the wars of the past as rulers and nation-states sought to expand their influence through control of energy sources. But you cannot just violently attack the Bitcoin network and take control of it. It is also impossible to invade another country to steal or control its bitcoins as they exist in cyberspace and can be sent anywhere within seconds if threatened. Bitcoin as an independent underlying strengthens our liberal value system. Violence becomes impractical.

In summary, it can be assumed that the US dollar will lose its sole position as the world’s leading reserve currency. There will be other competing reserve currencies like the Chinese yuan, used by countries with strong economic ties to China. This will be accompanied by a shift to holding gold and other commodities as central bank reserves, particularly in the East, but as bitcoin is increasingly accepted and recognized as a digital store of value, central banks will add it to their reserves.

We are already seeing the adoption of bitcoin as a reserve asset by small nation states. In September 2021, El Salvador became the first country to make bitcoin legal tender (bbc.com). Shortly after, President Nayib Bukele stated that his country bought 500 bitcoins at an average price of $30,744 to hold as a reserve asset. The Central African Republic was the second nation state to make bitcoin legal tender in April 2022 (Hoije, Goko, 2022). On May 16, Nayib Bukele announced that central banks and financial authorities from 44 countries would visit the El Salvador to discuss issues related to the digital economy, particularly bitcoin (Bicer, A). For developing countries like El Salvador that do not have an official currency, it is easier to adopt bitcoin since few changes need to be made to the existing monetary system. However, once larger nation-states understand the utility of bitcoin, it will be a matter of time before they too adopt bitcoin, albeit the process will be more complex.

Despite the ongoing changes, the dollar will remain important as the US remains home to the world’s most active financial ecosystems. In addition, the US bitcoin ecosystem is the largest in the world. Around 35 percent of the global hash rate, i.e. the energy that is fed to the Bitcoin network, comes from the US (Raynor de Best, 2022). The US will therefore benefit from a positive development of the Bitcoin network and could use bitcoin itself as a reserve asset. Which would give the dollar an underlying value. Regardless of its use as a global reserve asset or currency used in commodity trading. The progressive use of Bitcoin is part of an ongoing digitization of money. The global monetary system was digitized decades ago. Central bank deposits are managed almost exclusively electronically. Today electronic money is the most used form of currency. It is only logical that central banks will also hold a digital store of value. Within this change, bitcoin will play a central role. Of course, nothing is certain, but taken together, bitcoin’s qualities as a scarce digital store of value make it seemingly invincible.

12. Electronic money

Electronic money has existed long before Bitcoin. It refers to money stored in electronic systems and digital databases, as opposed to physical paper and coin money. It is used to facilitate electronic transactions. The value of traditional electronic currencies is backed by fiat money (corporatefinanceinstitute.com, 2022). Increasing international trade has led to an increased need for electronic money to enable fast cross-border payment processing. Electronic payments eliminate the hassle associated with physically delivering payments. It is the most common form of money today.

Electronic money can be divided into two categories hard and soft. Hard electronic money is used for irreversible transactions. For example, transactions drawn through a bank. Soft electronic money is when electronic money is used for reversible or flexible transactions. This includes transactions conducted with the help of payment providers such as PayPal or credit cards. A higher level of flexibility is offered and users can manage their transactions after the payment has been processed, e.g. cancel a transaction or change the price within a defined period of time after the transaction (corporatefinanceinstitute.com, 2022).

The use of electronic money became popular in the 1950s and 1960s with the introduction of credit cards. Automated teller machines (ATM) soon made it easier to use electronic money. Cash dispensers enabled a smooth exchange between electronic money and physical cash. Financial markets also went electronic around the same time. In 1969, Instinet introduced the first automated system for trading US securities. Today, most financial instruments are traded electronically (fxcm, 2016.). The use of electronic money continued to increase in the 1990s with the advent of the internet. E-commerce, the trade in goods and services on the Internet, is completely dependent on electronic payments.

There are a number of problems with conventional electronic money. First, it is predominantly backed by fiat money, which only exists as bank deposits. Central banks create it electronically on a computer screen. Banks then use this money when lending. For example, when a commercial bank issues a mortgage, it uses newly created money from a central bank, which is then paid out to the customer —the money didn’t exist before. The lender’s promise to pay back the money is what gives the money its value. It’s money based on debt. There is no commodity, effort or resource supporting it.

Secondly, electronic payments allow storing a digital historical record of every transaction made, they make it easier to track payments and help generate detailed reports on expenses, budgeting, etc.(corporatefinanceinstitute.com, 2022). While this can be beneficial for organizational purposes, there have been numerous instances in the past of governments and corporations abusing this feature to exercise control. In February 2022, the Canadian government froze bank accounts of people who donated to and participated in the Freedom Convoy, a series of protests and blockades in Canada against COVID-19 vaccine mandates and restrictions. In the wake of the protests, the Canadian government also invoked new emergency powers that expanded the ability of Canadian financial institutions and regulators to track and control funding for protesters (Barbara Shecter, NY Times, 2022).

Furthermoore, while it has become easier to buy goods online and process electronic payments, managing money has become increasingly complex. You are never master of your money, but always use a combination of third-party providers to make payments and store value. This creates a social trap in which individuals give up personal responsibility in the hope of comfort. But no central party will act in the interests of the individual (principal-agent problem). This leads to high fees to reduce the central authority’s incentive to act improperly (Poon, J. Dryja, T. “The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments” (2016). The introduction of Bitcoin in 2009 ushered in a new era of electronic money. It can be sent from user to user, peer-to-peer, without the need for intermediaries. Bitcoin was designed to be decentralized so that no single entity can control the network.

13. Bitcoin

The internet changed the way we interact, trade and make payments, but until Bitcoin it had little impact on money. In 1998, computer scientist Wei Dai introduced the concept of “cryptocurrency” to the Cypherpunks mailing list. He proposed the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority (bitcoin.org). Cryptography is the study of secure communication techniques that enable the creation of secure communication channels or, in the case of money, secure transaction channels, and the creation of electronic currencies. The idea was to create electronic cash whose value is created by the computing power used to create it, independent of the control of a central authority.

“I am fascinated by Tim May’s crypto-anarchy. Unlike the communities traditionally associated with the word “anarchy”, in a crypto-anarchy the government is not temporarily destroyed but permanently forbidden and permanently unnecessary. It’s a community where the threat of violence is impotent because violence is impossible, and violence is impossible because its participants cannot be linked to their true names or physical locations. [..] The protocol proposed in this article allows untraceable pseudonymous entities to cooperate with each other more efficiently, by providing them with a medium of exchange and a method of enforcing contracts. The protocol can probably be made more efficient and secure, but I hope this is a step toward making crypto-anarchy a practical as well as theoretical possibility.” (Wei Dei, “b-money” 1998)

Traditional centralized banking systems like the Federal Reserve System are governed by boards and government agencies that control the supply and distribution of money. In contrast, the Bitcoin protocol relies on predetermined mathematical properties to estimate the supply and demand of bitcoin using a rate that was defined when the system was created and made known to the public (Antonopoulos A,M. (2017). The Internet of Money. Merkle Bloom LLC). There will never be more than 21.000.000 bitcoin. This leads to advantages over the existing monetary system, which is based on human-made decisions that involve an unavoidable level of human error.

For the first time in history, no central party is required to determine the ownership, transfer, or creation of value. Satoshi Nakamoto has successfully solved the double spending problem and created a system with Bitcoin that does not require intermediaries. The revolutionary invention of Bitcoin not only led to a gradual improvement in our payment system, but also solved the problem of digital scarcity and created a digital store of value. We now have a reliable digital payment network. An important step in human development, because “civilization develops by increasing the number of important operations that we can perform without thinking about them” (Alfred North Whitehead).

Bitcoin is hope (Michael Saylor) because it allows everyone in the world to store value, regardless of gender, race, location or age, and provide for the future. This results in positive second-order effects. The inflationary fiat system that we live in today incentives short time thinking. Money that we earn today will lose value in the future, so we spend it on things we don’t need. We are incentivized to consume consistently, to waste the world’s resources and to make bad decisions because we don’t care about the future. Bitcoin is different. It’s disinflationary. It encourages long-term thinking. As Bitcoiners, we are more aware of the value of our money. Because it increases in value. Why should I spend my bitcoin on a car today when I can use it to buy a house in the future? This is part of a broader movement for socio-economic change. There is a need to separate two of society’s most powerful sectors – government and money. The state monopoly on money has always caused problems. Every national currency has collapsed at some point. With Bitcoin as the monetary network, the financial system will become cheaper, faster, more reliable, more innovative and more inclusive (Jack Mallers, 2022).

Bitcoin restores ideas of economic exchange as old as human civilization. The idea that money should be valuable and convenient to use. It is part of a fundamental step in the digitization of the world around us. It is a tool that will help society organize itself efficiently. Just as the introduction of money enabled the creation of cities, Bitcoin will enable a new way of wealth creation in the digital space (Bitcoin Magazine, 10 Year Anniversary Edition).

Sticking to the traditional definition of money is like describing a means of transportation as something with four legs and a tail. Just as the automobile has retired the horse and forced a redefinition of transportation, global commerce is undergoing a change that is redefining money. Bitcoin is part of this shift as it challenges the parameters of economics through the use and application of technology. It challenges our commonly held definitions of money as it redefines familiar assumptions of value (Pindar Wong, Unknown Interview). Money has always evolved, all you need is an exchange rate between the old and the new – which exists with the direct conversion of fiat money into bitcoin.

‘Denying Bitcoin is the same as believing that the Earth is still the centre of the heavens. Like the revelation that the earth revolves around the sun, the discovery of a digital, sound money system in Bitcoin is a scientific revolution. Perhaps, in 20 years, we can look back on this time and see that we have awakened from the monetary Dark Ages and can now build the world again under a sound money standard, the Bitcoin standard’ (Bitcoin Graffiti, 2022. “Bitcoin: The Ignition Of A Scientific Revolution”).

Continue reading: coming soon

_______

Follow me

Twitter

Instagram